Ircon International Limited Share Price Target 2024 2025 till 2030 and its future prediction:

Hey are you searching for an Ircon International Ltd. company share price target for 2024,2025, till 2030 future then you are in the right place, in this article I am going to analyze is the stock weather is good for long-term investment. is it is right time to buy the stock?

Friends today in the article I am going to analyze Ircon International Ltd shares based on its fundamentals, technical analysis, and business opportunities on these bases we can come to a conclusion about whether it is a good stock for long-term investment or not.

So let’s have a look at the company’s business model and financial conditions of the company and its business opportunities which will give us a quick idea about the company and how much the company share price target is capable of showing in the upcoming years.

Ircon International Limited is an infrastructure sector company and it was incorporated as Indian Railway Construction Company Private Limited on April 28, 1976, in Delhi, as a private limited company.

On 20 Nov 1976, the company became a public limited company and the company’s name was changed to Ircon International Limited.

Business Areas Of The Company

The company mainly works on large projects like Railway infrastructure, Highways construction, flyovers, Bridges, aircraft maintenance hangers, tunnels, runways, substations, commercial and residential properties, electrical and mechanical works, development of industrial areas, and other infrastructure activities.

The company specializes in new railway lines rehabilitation of existing line station buildings and specialties in signaling and telecommunication and Railway electrification.

Ircon International Company also undertakes project works for many other countries like Malaysia, Nepal, Bangladesh, Afghanistan, Algeria, and Sri Lanka where the company works on large projects which are related to railway construction.

Fundamentals of Ircon International Ltd.

| Market Cap | 6,371.99 Cr. |

| EPS | 7.72 |

| CEPS | 8.03 |

| PB | 1.22 |

| ROE | 14.90 |

| PE | 8.18 |

| Book Value | 54.22 |

| ROCE | 17.79% |

| Dividend Yield | 3.96% |

| Cash | 5,339.97 Cr. |

| DEBT | 0 |

| Sales Growth | 39.43% |

| Profit Growth | 34.55% |

Fundamental analysis of Ircon International Ltd.

The sales growth of Ircon International for the last year is 39.43% and for the last 3 years is 16.1% which indicates the sales are increasing yearly.

The profit growth of Ircon International for the last year is 34.55% and for the last 3 years is 7% which indicates the profit of the company is increasing year by year.

The ROE of the company for the last year is 12.06% and for the last 3 years is 11.19%. Which measures the ability of the firm to generate profits from its shareholder’s investment in the company.

The ROCE of the company for the last year is 17.73% and for the last 3 years is 18.57% which measures how efficiently a company is using its capital employed.

The debt-to-equity ratio of the company measures how the company is financing its operations through debt versus its own funds and the company’s debt-to-equity ratio is zero which is less than 1 it is a good indicator for the company.

The price-to-cash flow ratio is used to calculate a company’s market value with its cash flow which is nearly 4.73.

The interest cover ratio of the company can be used to determine how easily the company can pay interest on its outstanding debts and the company’s interest cover ratio is 4.21%.

The company is debt-free and the company is paying dividends to its investors the current year’s dividend paid to its investors is Rs. 2.50 and the dividend yield is 3.96%.

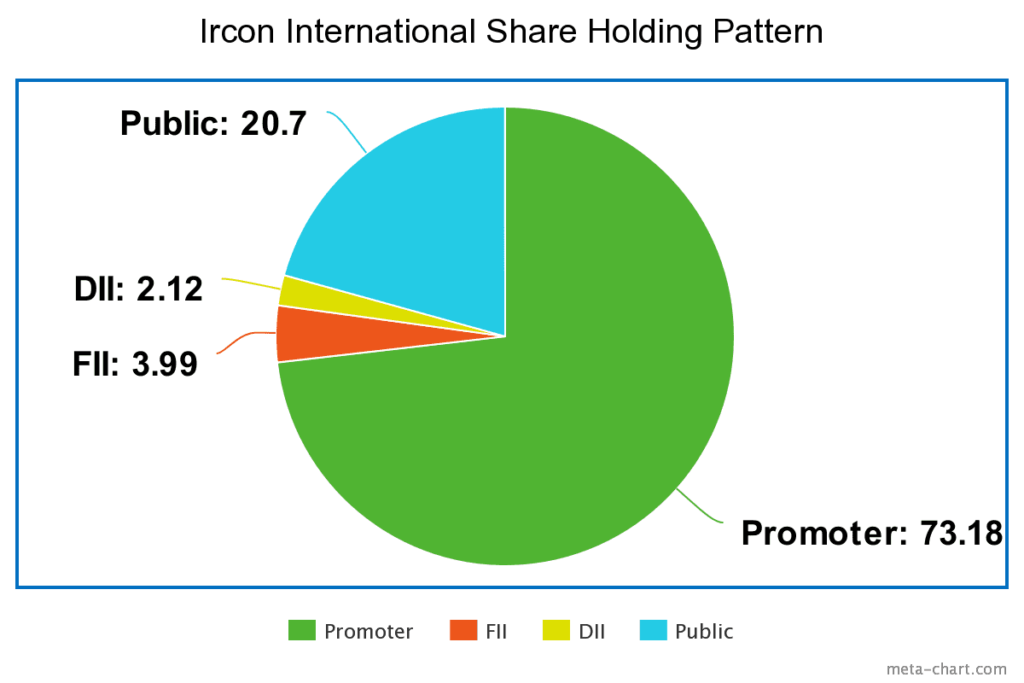

Ircon International Ltd. Shareholding Pattern

The promoter of the company is the Government of India and their shareholding is 73.18% which is more than 50%.

FII and DII shareholding in the company is 3.99% and 2.12% which is less than 10% which indicates the company is not able to attract smart money.

The public holding in the company is 20.7% which is more than 10%. More than 10% of the public investment in the company may create more liquidity in bad market conditions.

There is no stake pledging in the company.

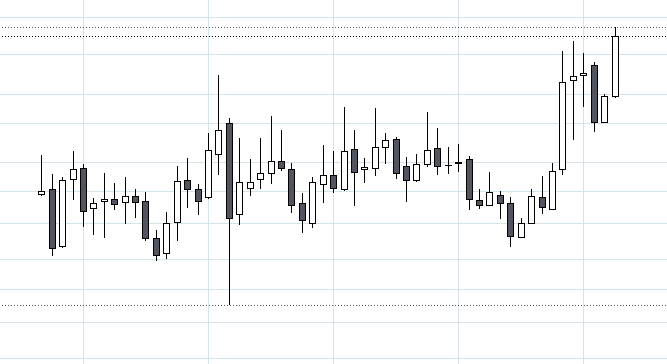

Technical Analysis of Ircon International Ltd.

Long-term point of view we are taking monthly charts to analyze the stock to understand its Trends and direction. Stock is listed in NSE on 3 September 2018 so it is only 5 years old stock.

As of now, the stock is trading at nearly 68 Rs. And the stock is near its all-time high which is 69.65 Rs. If the stock breaks its all-time high and sustains above this level then its first target will be 94 Rs. The second target will be 135 Rs. and the third target will be 176 Rs.

Read More: SBC Exports Ltd

Major Support And Resistance For Ircon International Ltd.

The first major support for the stock is 60 Rs and second support is 54 Rs and the third support is 49 Rs.

The first major resistance for the stock is 69 Rs the second resistance is 83 RS and the third resistance is 94 Rs.

Iron International Ltd Share Price Target

| Year | Minimum | Maximum |

| 2023 | 60 | 94 |

| 2024 | 82 | 135 |

| 2025 | 121 | 176 |

| 2026 | 163 | 222 |

| 2027 | 215 | 342 |

| 2028 | 328 | 502 |

| 2029 | 483 | 625 |

| 2030 | 605 | 765 |

Iron International Ltd Share Price Target 2023

Listed a few years back but the company has shown strong potential upside movement the company now working on a lot of big projects and the company is getting good orders from India as well as from abroad considering these the share price target for 2023 will be minimum of 60 maximum will be 94.

Iron International Ltd Share Price Target 2024

International Limited Company Management is planning to work in joint ventures and partnerships with other companies to increase the growth of their business. This will boost the business of the company some joint venture companies are IRSDC, CERL, ISTPL, CEWRL, and MCRL. This will help the company for future growth so the share price target for 2024 will be a minimum of 82 and a maximum will be 135.

Iron International Ltd Share Price Target 2025

The government of India is invested in railway construction like Vande Bharat Express, and bullet trains, so these projects help the company to grow in the future the share price target for 2025 will be a minimum of 121 and the maximum will be 176.

Iron International Ltd Share Price Target 2026

The company has a sound financial background and strong management that can help to expand its business so the share price target for 2026 will be a minimum of 163 and a maximum will be 222.

Iron International Ltd Share Price Target 2027

With different emerging business segments along with doing work related to railway construction, the company is also involved in highway projects considering this the share price target for 2027 will be a minimum of 215 and a maximum will be 342.

Iron International Ltd Share Price Target 2028

The share price target for 2028 will be a minimum of 328 and a maximum will be 502.

Iron International Ltd Share Price Target 2029

The share price target for 2029 will be a minimum of 483 and the maximum will be 625.

Iron International Ltd Share Price Target 2030

The share price target for 2013 will be a minimum of 605 and the maximum will be 765.

Read More: GAEL Share Price Target

Conclusion:

The Government of India is making a new plan to strengthen the railway infrastructure because of this the company has huge potential growth in the future. Because of this, the company has used opportunities for growth in the business of Ircon. So if you are considering a long-term investment and want to take advantage of this growth of railway infrastructure then this company looks like a very good company to invest in. But before making an investment decision do not forget to do a complete detailed analysis of the business and market conditions yourself. If you like this article comment below share this article with your friends and family and write us.