MTAR Technologies Share Fundamentals and Technical Analysis are necessary for investors to invest from the long-term point of view. but it is time-consuming and a lot of data analysis requires specialization in fundamental basics. so don’t worry we made it simple for you. In the article, we are going to analyze its fundamentals and technical-based data and give you a clear condition of its financial health report and technical report so let’s start.

MTAR Technologies is a prominent precision engineering solutions company specializing in the production of mission-critical precision components with exceptionally tight tolerances (5-10 microns) and complex assemblies.

The company serves projects of paramount national significance by leveraging its expertise in precision machining, assembly, testing, quality control, and specialized fabrication. Many of these competencies have been developed and manufactured in-house. MTAR primarily caters to customers in the clean energy, nuclear, space, and defense industries.

Information about MTAR Technology

| Name | MTAR Technology |

| Symbol | MTAR |

| Sector | Engineering |

| Founded | 1970 |

| Headquarters | Hyderabad |

| Locations | Hyderabad,Bangalore,Chennai |

| CEO | P. Anand Rao |

| Website | mtar.in |

Since its inception, MTAR has maintained a commitment to continuous growth, actively contributing to India’s civilian nuclear power program, space initiatives, defense and aerospace sectors, as well as global clean energy and defense and aerospace endeavors.

Over the years, the company has also successfully created domestic alternatives such as ball screws and water-lubricated bearings that are tailor-made for the industries it serves. MTAR’s extensive engineering capabilities, refined over decades, enable it to consistently deliver high-quality, intricate precision components and assemblies within specified timelines and often at competitive costs, fostering strong partnerships with its clientele.

The company currently operates from seven cutting-edge manufacturing facilities, including an export-focused unit (EOU), strategically located in Hyderabad, Telangana. These facilities are equipped with advanced machinery tailored for precision machining, assembly, testing, quality control, specialized fabrication, brazing, heat treatment, and other specialized processes. This comprehensive range of capabilities positions MTAR as an all-encompassing solutions provider for its customers.

Over time, the company has made substantial investments in improving processes, expanding infrastructure, and integrating systems. Additionally, it has placed a strong emphasis on specialized training for its technical team. These concerted efforts have firmly established MTAR as a significant player in the nuclear, space, and defense sectors. Furthermore, MTAR has implemented a variety of information technology solutions to aid in design and manufacturing operations, as well as enterprise resource planning (ERP) solutions to seamlessly integrate crucial aspects of its operations.

Core Business Focus:

MTAR Technologies specializes in the development and production of a diverse array of mission-critical assemblies and precision components, characterized by stringent tolerances (5-10 microns). These components are manufactured through precision machining, assembly, and specialized fabrication processes. The company’s primary clientele spans the clean energy, nuclear, space, and defense sectors, both within India and internationally.

Key Information of MTAR Technologies Ltd.

| Market Cap | 8378.76 Cr. |

| No. of Shares | 3.08 Cr. |

| PE | 77.98 |

| PB | 13.08 |

| Dividend Yield | 0 % |

| Book Value | 208.27 |

| Cash | 30.98 |

| DEBT | 142.79 Cr. |

| EPS | 34.93 |

| ROE | 18.25 % |

| ROCE | 22.53 % |

| Sales Growth | 78.05 % |

| Profit Growth | 70.95 % |

| CAGR | 63.5 % |

Here are some key financial metrics for MTAR Technologies:

- Price to Earnings (P/E) Ratio: The P/E ratio of 77.98 is relatively high, suggesting that investors are willing to pay a premium for the company’s shares. This could indicate that the stock is overvalued, although other factors should be considered.

2. Return on Assets (ROA): MTAR Technologies has a ROA of 11.62%, which is considered low. A higher ROA is generally more desirable as it indicates better efficiency in generating profits from the company’s assets.

3. Current Ratio: MTAR Technologies has a current ratio of 2.04, indicating its ability to cover short-term liabilities with short-term assets. A higher current ratio is typically seen as positive for stability during unexpected business challenges.

4. Return on Equity (ROE): The ROE for MTAR Technologies is 18.25%, which is a good sign. It demonstrates the company’s ability to generate profits from shareholders’ equity investments.

5. Debt to Equity (D/E) Ratio: With a D/E ratio of 0.23, MTAR Technologies has a low proportion of debt in its capital structure. This suggests a relatively conservative approach to financing.

6. Inventory Turnover Ratio: The inventory turnover ratio for MTAR Technologies is 2.06, indicating that the company may be less efficient in managing its inventory and working capital.

7. Sales Growth: MTAR Technologies has reported a revenue growth of 78.05%, which is considered fair and indicative of positive growth and performance.

8. Operating Margin: The operating margin for MTAR Technologies in the current financial year is 26.85%, which measures the company’s operational efficiency. This margin indicates that the company is operating efficiently.

9. Dividend Yield: For the current year, MTAR Technologies has not paid dividends, resulting in a dividend yield of 0%.

These financial metrics provide insights into various aspects of MTAR Technologies’ performance and financial health. It’s important for investors to consider these metrics alongside other factors when making investment decisions.

Share Holding Pattern:

It is important for every investor to understand the shareholding pattern and whether promoters are selling their stake if yes then it negative sign for the company, if promoters buy the stake in the open market then it is a good sign for the company that indicates the praters believe that the company is doing well.

If the promoters pledge their stake regularly then it is bad for the company’s reputation so it is better to understand the shareholding pattern of the company.

The promoter holding in MTAR Technologies is 39.14 % which is less than 50 % It affects the decision-making in the company.

FII and DII holdings in the company are 4.52 % and 28.01 % which indicates that the company is able to attract smart investors.

Public holding in the company is 28.33 % which is more than 20 % which may create more liquidity in the market.

Promoter pledging is 6.64 % as compared to previous pledging 8.27 which indicates that the pledging is reduced which is good for the company.

Technical Analysis of MTAR Technologies

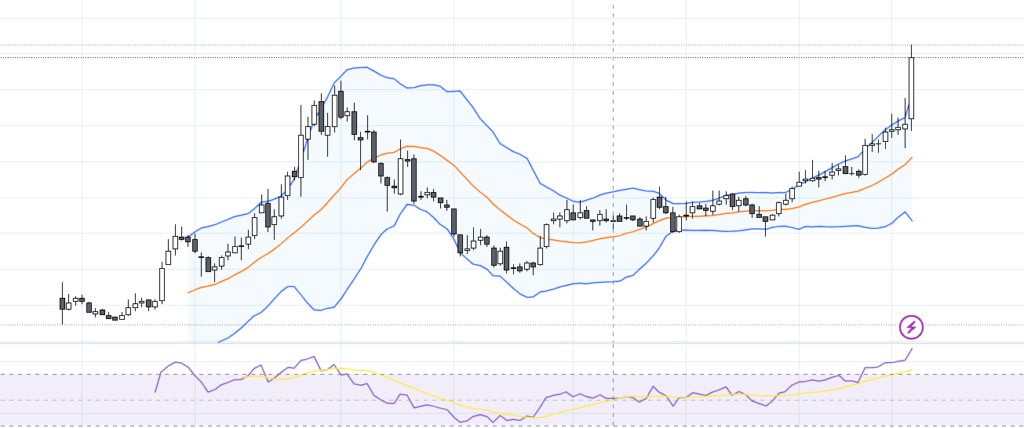

From the long-term point of view, we are taking weekly charts to identify it trend and direction for investment. When we look at the weekly chart the stock is trading at 2724 as of 1 Sep 2023. Recently the stock has broken its all-time high as well as its 52-week high which indicates that the stock has demand in the market and the buyer is ready to buy at any price in a given period of time.

The major resistance for the stock is 2800 if the stock sustains above this level then its first target will be 4000, the second target will be 7936, and the third target will be 9125.

Major Supports and Resistance for MTAR Technologies

The major supports for MTAR Technologies are first support is 2565, second support is 2326, and third support is 2152.

The major resistances are first resistance is 2818, second resistance is 3018, and third resistance is 3284.

Conclusion

MTAR Technologies is a fundamental and technically strong stock for long-term investment. If you are looking for engineering stock to invest then it looks good. Overall the fundamentals of the company are good and the stock has recently broken its all-time high and has potential demand in the market. The government of India is also encouraging the space research industry. So by considering all aspects and market conditions you can consider this stock for long-term investment. If you like this article share this article with your friends and family and rate us.