RITES Limited welcomes another article RITES Ltd. Share Price Target 2024 to 2050, Fundamentals and Future Plans. Today we are discussing RITES Ltd.’s Share price prediction based on its fundamental analysis. After reading this article you will get full details of the company and whether the stock is good for long-term investment or not.

The full form of RITES Ltd. is Rail India Technical and Electronic Service Limited.

The company was Incorporated in 1974 as a Rail India Technical and Electronics Services Private limited company under the Ministry of Railways. and the headquarters is located in Gurugram, Haryana.

In 1976 the title private was dropped and the company became simply Rail India Technical and Electronic Services Limited.

In 2000 the name changed to its current form RITES Limited.

In 2018 the company was listed on the National Stock Exchange of India.

Business Areas of The Company

The company acts as a stop shop for all your transportation structure needs and the company offers comprehensive solutions For planning and design contraction, operation and maintenance of Rail Infrastructure, Airports and ports, and Urban Transport.

The company has a diverse portfolio of products and services spanning across various transportation sectors such as

Railway engineering and consultancy

Project management

Infrastructure development

Rolling stock

Operation and maintenance

Transport infrastructure and consultancy

Highway Engineering

Metro and Rapid transit systems

Airports and ports

Urban transportation

Technology and innovation

Graphic information systems

Building information modeling

Intelligent transportation systems

Sustainability and Green Mobility

International Services

The company offers expertise and services to various countries across the globe and supports their transportation infrastructure development projects.

They have experience in regions like Asia Africa Latin America and the Middle East.

Management of RITES Ltd.

Chairman: Mr. Pradeep Kumar Saxena and IAS officer Pizza chairman of the company with extensive experience in infrastructure development and public administration.

Managing Director: The Managing Director of the company is Mr. Rahul Mittal, is a techno cart with over 30 years of experience in the Railway sector who played a key role in major projects like dedicated Freight Corridors.

Fundamentals of RITES Ltd.

| Sector | Engineering |

| Market Cap | 16454.67 Cr. |

| PE | 34.11 |

| PB | 6.62 |

| Dividend Yield | 2.99% |

| Book Value | 103.37 |

| Cash | 3396.66 Cr. |

| DEBT | 0 Cr. |

| Sales Growth | -2.16% |

| Profit Growth | 6.73% |

| ROE | 21.64% |

| ROCE | 29.18% |

Fundamental Analysis of RITES Ltd.

By Understanding Major Ratios we will better understand the future growth of the company.

Profitability Ratios:

Net Profit Margin: The net Profit Margin of RITES Ltd. is 19.32%, which indicates the company can generate profit from revenue.

EBITA Margin: The EBITA margin of RITES Ltd. is 29.75%, which indicates the strong operating efficiency of the company.

Return on Equity: ROE of RITES Ltd. is 24.4% which shows efficient utilization of shareholders capital from the company.

Solvency Ratios:

Debit to Equity Ratio: The debt to Equity Ratio of RITES Ltd. is 0.16 which is a very low ratio, indicating minimal burden and strong financial strength.

Current Ratio: The current Ratio of RITES Ltd. is 1.72 which suggests the company has sufficient assets for its short-term obligations.

Interest Coverage Ratio: The Interest Coverage Ratio of RITES Ltd. is 108.03 which is a high ratio that conforms to the company’s ability to comfortably service it’s interest expenses.

Liquidity Ratios:

Quick Ratio: Quick Ratio of RITES Ltd. is 0.63, which indicates some potential challenges in meeting immediate obligations with immediate assets.

Valuation Ratios:

Price to Earning Ratio: The Price to Earning Ratio of RITES Ltd. is 34.71, which is relatively high compared to the industry average, but justified by strong growth prospectus and consistent profitability.

Opportunities for RITES Ltd.

Growing Indian infrastructure market.

Expansion into new segments like urban transportation and logistics.

International market exploration.

Threats for RITES Ltd.

Macroeconomic factors such as inflation and interest rate hikes.

Competition from peer companies.

Regulatory changes.

Balance Sheet of RITES Ltd.

| Particulars | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 |

| Equity and Liabilities | |||||

| Share Capital | 200 | 250 | 240.3 | 240.3 | 240.3 |

| Total Reserves | 2,183.83 | 2,326.62 | 2,081.63 | 2,158.96 | 2,262.74 |

| Borrowings | 0 | 0 | 0 | 0 | 0 |

| Other N/C liabilities | 113.4 | 242.47 | 193.95 | 145.48 | 237.74 |

| Current liabilities | 2,678.72 | 2,891.09 | 3,075.78 | 3,000.48 | 2,950.28 |

| Total Liabilities | 5,175.95 | 5,710.18 | 5,591.66 | 5,545.22 | 5,691.06 |

| Assets | |||||

| Net Block | 338.87 | 411.95 | 412.91 | 392.47 | 391.84 |

| Capital WIP | 2.32 | 4.45 | 15.48 | 58.01 | 94.8 |

| Intangible WIP | 1.59 | 0 | 0 | 0 | 0 |

| Investments | 180.01 | 179.87 | 202.75 | 152.75 | 127.75 |

| Loans & Advances | 143.82 | 117.62 | 162.85 | 244.08 | 266.7 |

| Other N/C Assets | 37.46 | 23.18 | 51.48 | 135.27 | 90.24 |

| Current Assets | 4,471.88 | 4,973.11 | 4,746.19 | 4,562.64 | 4,719.73 |

| Total Assets | 5,175.95 | 5,710.18 | 5,591.66 | 5,545.22 | 5,691.06 |

PNL of RITES Ltd.

| Particulars | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 |

| Net Sales | 1,968.97 | 2,400.57 | 1,843.15 | 2,575.16 | 2,519.62 |

| Total Exp. | 1,451.68 | 1,798.47 | 1,337.55 | 1,923.17 | 1,864.24 |

| Operating Profit | 517.29 | 602.1 | 505.6 | 651.99 | 655.38 |

| Other Income | 196.32 | 264.88 | 104.41 | 86 | 119.16 |

| Interest | 4.71 | 3.44 | 2.85 | 4.96 | 6.62 |

| Depreciation | 32.18 | 40.93 | 44.81 | 58.47 | 59.38 |

| Exceptional Items | 0 | 0 | 0 | 0 | 0 |

| Profit Before Tax | 676.72 | 822.61 | 562.35 | 674.56 | 708.54 |

| Tax | 232.07 | 226.22 | 138 | 177.46 | 178 |

| Net Profit | 444.65 | 596.39 | 424.35 | 497.1 | 530.54 |

| Adjusted EPS (Rs.) | 17.79 | 23.86 | 17.66 | 20.69 | 22.08 |

Key observations:

RITES Ltd. shows consistent growth in both revenue and profit after tax over the 5 years, except for a slide deep in the 2020 financial year.

The profit margin of the company has remained healthy throughout the period, ranging from 19.32% to 24.14%.

Cash Flow Statement of The Company

| Particulars | Mar-19 | Mar-20 | Mar-21 | Mar-22 | Mar-23 |

| Profit from operations | 676.72 | 822.61 | 562.35 | 674.56 | 708.54 |

| Adjustment | -116.8 | -105.14 | -80.41 | 44.15 | 7.51 |

| Changes in Assets & Liabilities | -195.74 | -250.49 | 85.93 | -251.76 | -80.34 |

| Tax Paid | -230.11 | -200.17 | -99.69 | -175.86 | -164.24 |

| Operating Cash Flow | 134.07 | 266.81 | 468.18 | 291.09 | 471.47 |

| Investing Cash Flow | 140.17 | 89.29 | 209.85 | 143.06 | 182.57 |

| Financing Cash Flow | -260.14 | -399.16 | -691.92 | -425.84 | -438.39 |

| Net Cash Flow | 14.1 | -43.06 | -13.89 | 8.31 | 215.65 |

Key Observations:

The company has consistently generated positive operating cash flow over the past 5 years, indicating its ability to generate cash from its core business operations.

The company is investing in Assets and projects, leading to negative investing cash flow in most years.

The company’s debt has decreased in recent years.

The free cash flow of the company in the past three years is positive which implies its ability to invest in growth and potentially distribute dividends to shareholders.

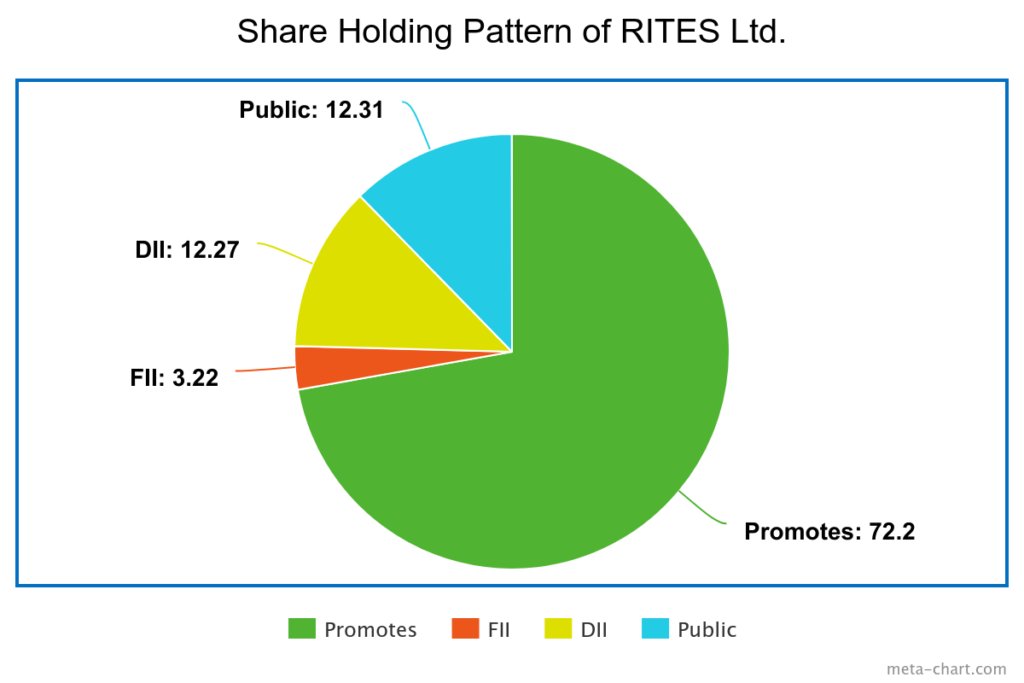

Share Holding Pattern of RITES Ltd.

The promoters have a 72.2% stake, a strong controlling stake in the company, providing stability and long-term vision.

FII holding 3.22% in the company indicates confidence in the company’s prospectus.

DII holding in the company is a 12.27% stake in the company.

The public holding in the company is a 12.31% stake in the company.

The participation of the retailer investors in the company is moderate, suggesting that the stock might not trade as widely as large-cap companies.

RITES Ltd. Share Price Targets

| Year | Minimum | Maximum |

| 2024 | 559 | 767 |

| 2025 | 741 | 897 |

| 2030 | 1142 | 1570 |

| 2040 | 2111 | 1570 |

| 2050 | 3727 | 4346 |

RITES Ltd. Share Price Target 2024

RITES Ltd. Has a strong financial track record and is one of the major infrastructure development companies, has a strong track record in the infrastructure field so the RITES Ltd. Share price target for 2024 will be a minimum of 559 and a maximum of 767.

RITES Ltd. Share Price Target 2025

RITES Ltd. Now uptrend indicates the strong demand for the stock in the present market so we are expecting the RITES Ltd. Share Price Target for 2025 will be a minimum of 741 and a maximum of 897.

RITES Ltd. Share Price Target 2030

If the macro economy and micro economy and govt regulations are in the fever of the sector then we are expecting the RITES Ltd. Share Price Target for 2030 will be a minimum of 1142 and a maximum of 1570.

RITES Ltd. Share Price Target 2040

The technical and fundamentals and the trend of the sector will indicate that RITES Ltd.’s Share Price Target for 2040 will be a minimum of 2111 and a maximum of 2446.

RITES Ltd. Share Price Target 2050

As per experts view the infrastructure sector has potential growth in the future so we are expecting RITES Ltd. Share Price Target for 2050 will be a minimum of 3727 and a maximum of 4346.

Conclusion:

RITES Ltd. is a good company with a good track record and growth potential. The company also has strong financial performance, and diverse business segments and the company has government support for infrastructure projects. The growing demand for infrastructure development will boost the company’s performance in the future. So before investment consider all market conditions and sector performance. The information is only for reference purposes.

FAQ:

What is RITES Ltd. Share Price Target 2024?

RITES Ltd. Has a strong financial track record and is one of the major infrastructure development companies, has a strong track record in the infrastructure field so the RITES Ltd. Share price target for 2024 will be a minimum of 559 and a maximum of 767.

What is RITES Ltd. Share Price Target 2025?

RITES Ltd. Now uptrend indicates the strong demand for the stock in the present market so we are expecting the RITES Ltd. Share Price Target for 2025 will be a minimum of 741 and a maximum of 897.

What is RITES Ltd. Share Price Target 2040?

The technical and fundamentals and the trend of the sector will indicate that RITES Ltd.’s Share Price Target for 2040 will be a minimum of 2111 and a maximum of 2446.