Today in this article I am going to analyze the Signet Industries Ltd. share price target for 2023,2024, 2025, and 2030 based on its fundamentals and technical analysis. By reading this article you will be able to understand whether Signet Industries is a multi-bagger share are not and is wreath it to invest in this stock for the long term so let’s start.

Before diving into deep let’s understand what is Signet Industries, its business model, management, future plans, financial conditions, and its competitors because it is important for every investor to know where he is investing, why he is investing, and whether is it a good investment for the future.

Let’s understand Signet Industries Limited

Signet Industries Limited formally known as Signet Overseas Limited was incorporated on Sep 18, 1985, in India. The registered office company is located in Mumbai, India. The company has manufacturing units in Maharashtra, Rajasthan and Gujarat.

Business Areas and Products of Signet Industries Ltd.

The company is engaged in the manufacturing of a wide range of plastic products, including rigid PVC pipes and fittings, PVC sheet films, and PVC compounds. Signet Industries also has a wind power division, The company has a total installed wind power capacity of 200 MW plants in Rajasthan and Maharashtra.

Some of the Plastic product list of Signet Industries Ltd.

The company is engaged in the manufacturing of a wide range of plastic products, including rigid PVC pipes and fittings, PVC sheet films, and PVC compounds. Signet Industries also has a wind power division, The company has a total installed wind power capacity of 200 MW plants in Rajasthan and Maharashtra.

- Rigid PVC pipes and fittings

- HDPE pipes and fittings

- PVC sheets and films

- PVC compound

- Molded Furniture

- Household products

- Crates

- Ghamela (unbreakable plastic buckets)

Signet Industries’ products are marketed under the brand names ‘Signet’ and ‘Supreme’.

Customer Base

The major customers are govt of India, ITC, and Larsen & Toubro.

Signet Industries supplies PVC pipes and fittings to Larson & Toubro. For Govt of India, the company supplies Irrigation pipes and fittings for the National Rural Drinking Water Program and for ITC the company supplies plastic packaging products.

Management of Signet Industries Limited

- Kirt Sikka: President and Managing Director

- Anupam Lal: Vice President (Operations) – North India

- Bhushan Kumar: Vice President (Projects)

- Namita Yadav: Senior Executive Human Resources

- Rajesh Sinha: General Manager

- Pragnesh Oza: Assistant General Manager

- Omnath Verma: General Manager

- Hemant Pandya: Engineer

- The chairman and managing Director of Signet Industries is Mr. Kirt Sikka who has 30 years of experience in the plastic industry.

- The voice chairman of Signet Industries Limited is Anupam Lai who has 20 years of experience in the plastic industry operating in north India.

- The project voice Chairman of Signet Industries is Mr. Bhushan Kumar who has 25 years of experience in the plastic industry and is also responsible for managing the company’s new projects and plan expansion.

Fundamental Overview of Signet Industries Ltd.

| Sector | Trading |

| Market Cap | 229.90 Cr. |

| PE | 15.56 |

| PB | 1.1 |

| Dividend Yield | 0.65% |

| Book value | 71.22 |

| Cash | 15.22 |

| DEBT | 309.02 Cr. |

| EPS | 5.02 |

| ROE | 6.50% |

| ROCE | 12.42% |

| Sales Growth | 16.01% |

| Profit Growth | 58.34% |

Fundamental Analysis of Signet Industries Ltd.

Balance sheets of Signet Industries Ltd. for the last 5 financial years:

| Financial year | Total assets (₹ crore) | Liabilities (₹ crore) | Equity (₹ crore) |

| 2022-23 | 231.23 | 15.22 | 216.01 |

| 2021-22 | 191.32 | 11.01 | 180.31 |

| 2020-21 | 165.21 | 9.42 | 155.79 |

| 2019-20 | 142.01 | 8.22 | 133.79 |

| 2018-19 | 121.52 | 7.11 | 114.41 |

The company’s total assets, liabilities, and equity have all increased over the past 5 years. This indicates that the company is growing during this period.

The company’s debt-to-equity ratio has remained relatively stable over the past 5 years, at around 0.1:1. This means that the company has a relatively healthy financial structure.

P&L statement of Signet Industries Ltd.

| Financial year | Revenue (₹ crore) | Profit before tax (₹ crore) | Profit after tax (₹ crore) |

| 2022-23 | 1087.37 | 32.33 | 18.47 |

| 2021-22 | 912.34 | 28.71 | 17.48 |

| 2020-21 | 826.34 | 26.11 | 15.68 |

| 2019-20 | 753.21 | 23.52 | 13.87 |

| 2018-19 | 698.42 | 21.11 | 12.32 |

The profit margin of the company has remained stable at around 3% over the last 5 years. Which means the company is generating a good profit margin on its revenue.

The net profit margin after the tax for the last 5 years is relatively stable at around 1.7%, this means the company is generating a good net profit margin on its revenue.

The Revenue, profit before tax, and profit after tax all are increasing over the last 5 years which indicates that the company is growing during this period.

Let’s have a look at some financial Ratios that clearly indicate of financial health of the company. Some of them are:

PE ratio: The PE ratio of the company is 15.56 in indicates that the company is now overvalued.

ROA ratio: Return on Asset of Signet Industries Ltd. is 1.80% which is bad for the company’s future performance.

ROE ratio: The return on equity of Signet Industries is 6.50%. this is used to measure the ability of the company can generate profits from its shareholder’s investments.

Debt to equity ratio: Debt to equity ratio of Signet Industries Ltd. Is 1050 which means the company has a low proportion of debt in its capital.

Sales Growth: The sales growth of the company is 16.01% which is considered good for its growth and performance.

Dividend Yield: the current year dividend yield of Signet Industries Ltd. Is 0.65% and the dividend is 0.50.

Dividend Policy

Signet Industries Limited has a consistent track record of paying dividends to its shareholders. The company has a dividend policy of paying out at least 30% of its profits after tax as dividends to its shareholders.

The dividend policy of the company is good the company pays regular dividends to its shareholders. The company is paying at least 30% of its profits after tax as dividends to its shareholders.

Here is the last 5 year Dividend History of Signet Industry

| Financial year | Dividend per share (₹) | Dividend yield (%) |

| 2022-23 | 2.50 | 1.61 |

| 2021-22 | 2.25 | 1.50 |

| 2020-21 | 2.00 | 1.38 |

| 2019-20 | 1.75 | 1.23 |

| 2018-19 | 1.50 | 1.10 |

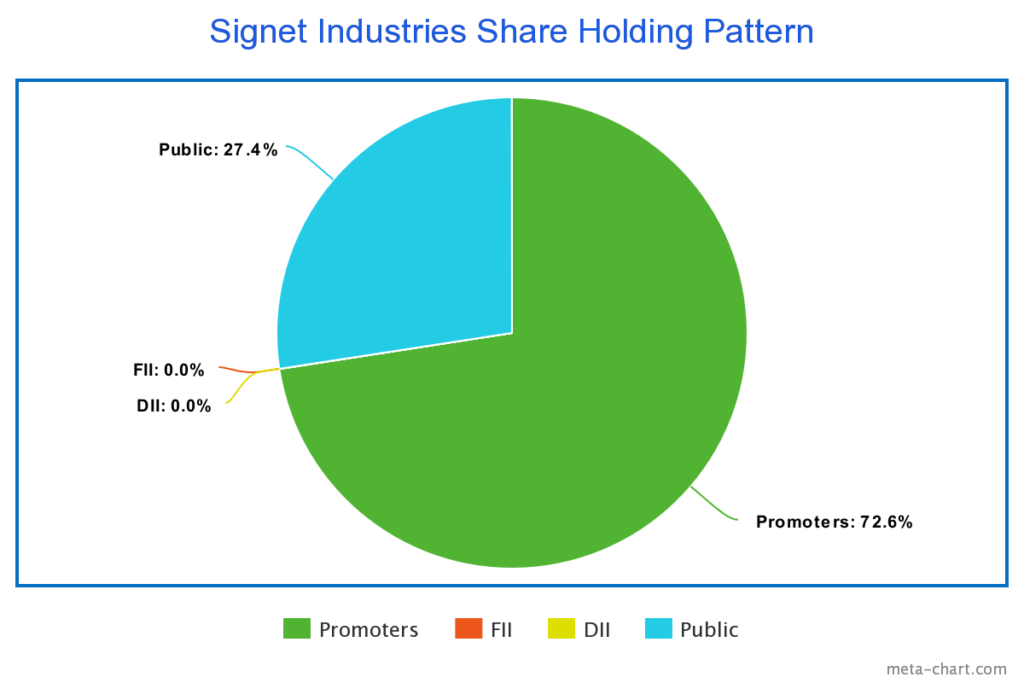

Share Holding Pattern of Signet Industries Ltd.

The promoter holding in the company is 72.57% which indicates that the promoters believe that they will grow in the future. And there is no share pledging of the company.

FII and DII holding in the company is 0% which indicates that the company fails to attract smart investors.

Public holding in the company is 27.43% which may create more liquidity in the market.

Technical analysis of Signet Industries Ltd.

Technical analysis is important for right entry and exit if you are keen to invest for the short term. Technical analysis also helps the trend of the stock. So to analyze the stock we are taking a monthly chart to predict its future movement.

On the monthly chart, the stock created w pattern and broke its all-time high. Now the the stock is uptrend. If the stock sustains above 85 then its first target will be 128 and second target will be 200 and third target will be 270.

The major support for Signet Industries Ltd. Is 70 and the second support is 65.

Signet Industries Ltd. Share price Target/prediction/forecast

| Year | Minimu | Maximum |

| 2023 | 69 | 84 |

| 2024 | 75 | 128 |

| 2025 | 80 | 199 |

| 2030 | 269 | 312 |

Signet Industries Ltd. Share price Target 2023

The Balance Sheet of the company is quite good which indicates that the company will generate good profit in the future so the share price for 2023 will be a minimum of 69 and a maximum will be 84.

Signet Industries Ltd. Share price Target 2024

Signet Industries Ltd. Plans to expand its manufacturing capacity for rigid PVC pipes and fittings by 20% in the next financial year this will boost the production capacity of the company so the share price target for 2024 will be a minimum of 75 and the maximum will be 128.

Signet Industries Ltd. Share price Target 2025

Signet Industries Ltd. Is planning to enter the market for plastic packaging products next year which boost its revenue. As e-commerce grows plastic packaging products are increasing the demand for packaging products so the share price target for 2025 will be a minimum of 80 and a maximum will be 199.

Signet Industries Ltd. Share price Target 2030

Signet Industries Ltd. Is exploring opportunities to expand its wind power capacity, solar power, and other renewable energy. As increasing demand for electricity creates business opportunities for the company the share price for 2030 will be a minimum of 269 and a maximum of 312.

Conclusion:

The balance sheet of Signet Industries is quite good and the profit of the company is also good. The company is expanding its business and trying to enter new business. The company also has strong management and a good marketing network which will push the growth of the company. As the demand for electricity increases that creates business opportunities for the company so the company looks good. If considering investing then check all market conditions and trends of stock before investing. This is not any buy or sell recommendation. If you like this article comment below share this article with your friends and family and rate us.

Read more: KIOCL Ltd. Share price target 2023, 2024, 2025 till 2030.

FAQ:

What is Signet Industries Ltd?

Where is Signet Industries Ltd headquartered?

Who are the key management personnel of Signet Industries Ltd?

● Kirt Sikka: President and Managing Director

● Anupam Lal: Vice President (Operations) – North India

● Bhushan Kumar: Vice President (Projects)

● Namita Yadav: Senior Executive Human Resources

● Rajesh Sinha: General Manager

● Pragnesh Oza: Assistant General Manager

● Omnath Verma: General Manager