NHPC Ltd. Share Price Target 2023, 2024, 2025 till 2030, its future prediction, and is this stock good for long-term investment, If you are searching for these questions then you are in the right place.

In this article, I will analyze the NHPC Limited share price target and future prediction based on its fundamentals and technical analysis after reading this article you will get complete details of NHPC Limited and its future forecast.

NHPC Ltd is a power generation and distribution sector company incorporated on 7 November 1975 as a private limited in Faridabad, India, and a company named National Hydroelectric Power Corporation Private Limited. Later the company was converted to a public limited company with effect from 2 April 1986.

The company’s main promoter is the President of India acting through MOP.

Areas of the company.

NHPC Ltd is a company that is engaged in the construction and operation of hydroelectric power projects. The company also diversified its business in the field of solar and wind power.

Fundamentals of NHPC Ltd.

Based on fundamentals we can get a clear understanding of the company’s performance and its strengths and weaknesses.

| Market cap | 44,479.41 Cr. |

| PE | 11.63 |

| PB | 1.25 |

| EPS | 3.81 |

| Book Value | 36.63 |

| Dividend Yield | 4.09% |

| Cash | 1,160.71 Cr. |

| DEBT | 26,017.64 Cr. |

| ROE | 10.87% |

| ROCE | 5.84% |

| Sales Growth | -1.80% |

| Profit Growth | 9.02% |

Fundamental analysis of NHPC Ltd.

Some ratio on analysis of the stock is a key element to understanding the financial State Health of the company. Here are some ratios and analyses given below to better understand the financial condition of the company.

Sales Growth: The sales growth of the company for the last year is -1.8% for the last 3 years is 0.78 percent which indicates the company sales are decreasing.

Profit Growth: The profit growth of the company for the last year is 9.02% and for the last 3 years is 10.38% which indicates that the profits are increasing yearly.

ROE%: It is used to measure the ability of the company to generate profits from its shareholder investment in the company. The ROE of the company for the last year is 10.87% and for the last three years is 10.52%. Which is increasing yearly.

Debt/Equity: It is used to measure how the company is financed in its operation through debit versus its own fund. It should be less than 1 and the debt-to-equity ratio of the company right now is 0.78 which is more than 0.50 which indicator that the company has an interest payment burden.

Interest cover ratio: It is used how easily a company can pay interest on its outstanding debt higher ratio is better for the company interest cover ratio of the company is 5.91 which is decent.

PE Ratio: It is used to measure whether the company is overvalued or undervalued the PE ratio of the company is 10.81 which is low and the company is right now undervalued.

Dividend Yield: it is used on how much dividend will receive in relation to the price of the stock. The dividend payment of the company for the year is 1.81 Rs and the yield is 4.06%.

Read More: Best Stocks To Buy Today Under 100 Rs In 2023

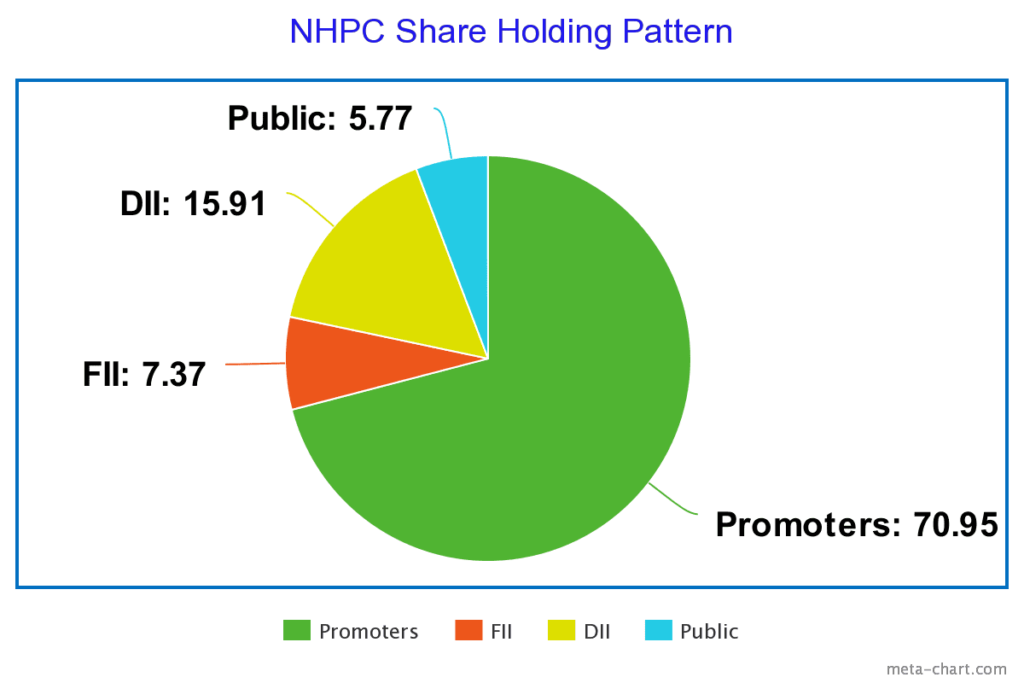

Share Holding Pattern of the NHPC Ltd.

It is better to understand me shareholding pattern of the company and whether the company is pledging its stake to repay the debt.

The promoter’s shareholding in the company is 70.95% which indicates that the promoters believe that the company can grow in the future.

FII and DII shareholding in the company is 7.37% and 15.91% which indicates that the company is able to attract smart money to invest in the company.

Public holding in the companies is 5.77% which indicates that the company had stability c in the market.

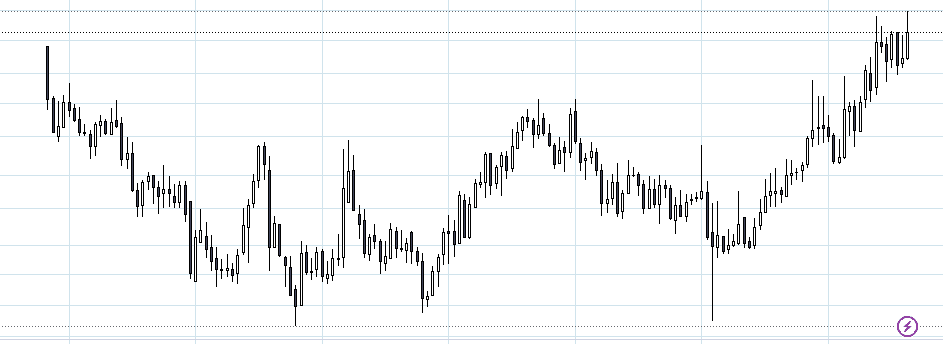

Technical analysis of the NHPC Ltd.

Technical Analysis helps to enter the stock and exist in the stock for the short-term investment of 3 to 5 years. To understand future Movement in the stock we are taking a monthly chart to analyze its future moment.

On the monthly chart, the stock is trading at nearly its all-time high which is 48 Rs. The stock is in an up Trend making a higher high and higher low. If the stock breaks its all-time high and sustains above this level then its first target will be 57 the second target will be 68 the target will be 80.

NHPC Share Price Target/Prediction/Forecast

| Year | Minimum | Maximum |

| 2023 | 42 | 51 |

| 2024 | 48 | 67 |

| 2025 | 60 | 79 |

| 2026 | 75 | 100 |

| 2027 | 92 | 133 |

| 2028 | 125 | 163 |

| 2029 | 151 | 206 |

| 2030 | 193 | 246 |

NHPC Share Price Target 2023

The demand for electricity is increasing in the country regularly because of this the largest company of hydroelectric power NHPC is going to get the full blanket of this increasing demand. The experts believe that due to this increasing demand for electricity, the safe target for 2023 will be a minimum of 42 and a maximum of 51.

NHPC Share Price Target 2024

Due to the good financial conditions of NHPC, we expect more jump in its share price. The company is trying to increase the use of increasing demand.

Now NHPC has 24 Power Projects along with pending projects. The company is trying to complete these projects as soon as possible. If the company is able to complete this project then a boom in its business.

We can expect the NHPC share price target in 2024 will be a minimum of 48 and a maximum of 67.

NHPC Share Price Target 2025

The Government of India is promoting the use of electric vehicles which can increase the demand for electricity in the future so this will increase the demand of electricity it can help the business growth of the company in the future so the share price target in 2025 will be a minimum of 60 and a maximum will be 79.

NHPC Share Price Target 2026

The company is working continuously on Clean Energy for this the company getting Government support in its business due to this the company has the full potential to become a big company in the field of electricity production.

so we can expect the share price for 2026 will be a minimum of 75 and a maximum of 100.

NHPC Share Price Target 2027

The company along with the hydroelectrical plant is also working on renewable energy. Currently, the company has only one solar power station and one wind power station. The company is trying to increase the number of solar power stations and wind power stations.

In 2027 NHPC’s share price target will be a minimum of 92 and a maximum of 133.

NHPC Share Price Target 2028

NHPC’s share price target in 2028 will be a minimum of 125 a maximum of 163.

NHPC Share Price Target 2029

The share price target for 2029 will be a minimum of 151 and a maximum of 206.

NHPC Share Price Target 2030

The share price target for 2013 will be a minimum of 193 and a maximum of 246.

Read More: Refex Industries Share Price Target

Conclusion:

NHPC is a power generation and distribution sector company. As we know the demand for electricity is increasing yearly. The company has full potential growth in the future due to the demand for electricity. The company’s fundamentals and Technical are good. The company also pays a dividend to its investors which means the company generates regular income for the investor. So if you considering long-term investment then you may check all the detailed analyses mentioned above and check the market condition and sector performance before investment. If you like this article comment below and share this article with your friends and family and rate us.

FAQ:

Is NHPC debt free?

NHPC has 26,017.64 Cr. in its balance sheet.

Is NHPC profitable?

The profit growth of the company for the last year is 9.02% and for the last 3 years is 10.38% which indicates that the profits are increasing yearly.

Who owns NHPC share?

The company’s main promoter is the President of India acting through MOP.