Refex Industries’ share price target is 2024,2025 till 2030 and its future prediction

Friends are you searching for Refex Industries’ share price target 2024,2025 till 2030 and its future prediction then you are in the right place in this article I am going to discuss Reflex Industry’s share price target based on its fundamental analysis and technical analysis we can make a judgment whether is this stock best for long term investment or not.

Before we go into deep analysis let’s have a look at its history and its business model. After all, we are investing in business, not in a company. If the business is good then we can expect a good return.

Refex Industries Limited was 20 years old company it was incorporated in 2009 under the name of Refex Refrigerants Private Limited in 2006 the company was converted into a public limited company and the Name of the company was changed to Refex Industries Ltd. Later in 2007 the company was listed on the Bombay Stock Exchange. Later in 2009, the company was listed in NSE.

The main business of the company is refilling refrigerant gases (Ozone-friendly hydrochlorocarbons).

The company has also been engaged in Solar Power Projects since 2011 the company phones f are you MW ground-mounted solar power project in Barmer district Rajasthan.

The company also diversified its business into coal handling and fly ash disposal business in 2018.

Business areas of the company

- Refrigerant gases

- Coal and fly ash handling

- Solar energy and power trading

The refilling facility of the company is located in Tamilnadu and the commercial warehouse of the company is located in Delhi.

About The Company

| Company Name | Refex Industries Ltd |

| Sector | industrial Gases & Fuels |

| Headquartres | Chennai Tamil Nadu |

| Chairman | Mr. Anil Jain |

| Website | https://refex.co.in/ |

Fundamentals Of Refex Industries Ltd.

| Market Cap | 731.08 Cr. |

| EPS | 40.44 |

| CEPS | 43.36 |

| PE | 8.18 |

| PB | 3.28 |

| ROE | 40.05 |

| Dividend Yield | 0% |

| Book Value | 119.30 |

| DEBT | 15.08 Cr. |

| Cash | 0.99 Cr. |

| ROE | 28.06% |

| ROCE | 41.68% |

| Sales Growth | -29.83% |

| Profit Growth | 10.86% |

Fundamental Analysis Of Reflex Industries Ltd.

Fundamental analysis is necessary to know how the company manages its funds to generate profit and to know if the company is in profit or loss.

Some ratios are analyzed here to understand the financial health of the company.

PE ratio- The price-to-earnings ratio is used to measure every rupee of earnings and how much an investor is willing to pay for a share. Legs or Industries Ltd’s PE ratio is 7.80 which is low and the company is right now undervalued.

The sales growth of the company for the last year is -29.83% for the last 3 years is -1.25% and for the last 5 years is 63.74%. This indicates the sales of the company are decreasing which is not a good sign for the company.

The profit growth of the company for the last year is 10.86% for the last 3 years is 12.79% and for the last 5 years is 150.18%. This indicates that the company generates consistent profit.

ROE means the return on investment it is used to measure the ability of the company to generate profits from its hair folders investment in the company. The Aarohi of the company for the last year is 28.06% for the last 3 years is 40.64% and for the last five years is 49.62%. It indicates that the company gives good returns to its investors.

ROCE is used to measure how efficiently a company is using its capital employed. The ROCE of the company for the last year is 41.68% for the last 3 years is 61.142% for the last 5 years is 50.28%.

The debt-to-equity ratio is used to measure how a company is financing its operations through debit versus owned funds. The debt-to-equity ratio of the company is 0.08% which is less than one percent less than 1% is good for the company.

The interest cover ratio is used to determine how easily a company can pay interest on its outstanding debt. Generally higher ratio is better for the company. The company’s interest cover ratio is 7.35 which is decent.

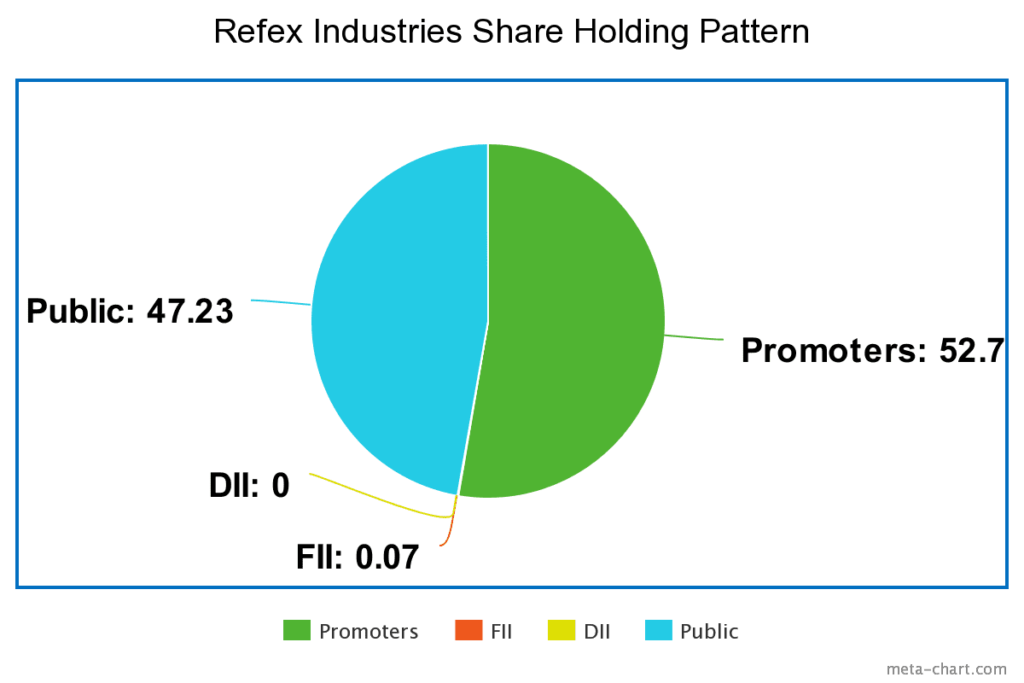

Reflex Industries Ltd. Shareholding Pattern

It is important to know the shareholding pattern because in some cases the promoters are willing to pledge their stake to repay the debts and this creates a burden on the company.

The promoter holding in the company is 52.7% indicate the promoters believe that the company can grow in the future.

FII and DII holdings in the company are 0.07% and 0% which indicates that the company is not able to attract smart money.

Public holding in the company is 42.23% which is more than 10% this may create a panic selling in bad results outcome in the stock market.

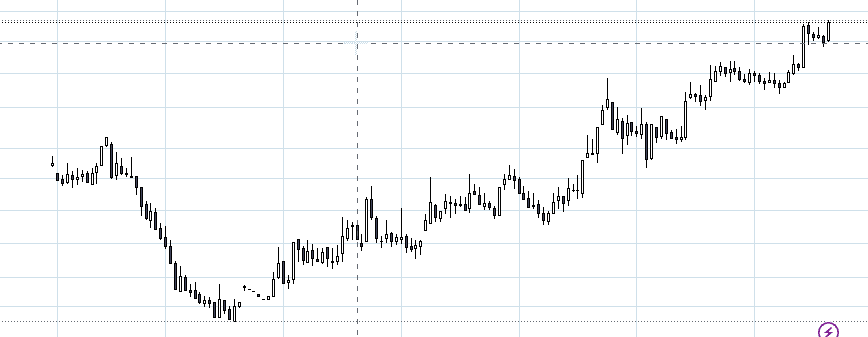

Technical analysis of Refex Industries Ltd.

Technical analysis is used to get a clear picture of the stock’s direction and its future moment. To understand stock direction and future movement we are taking monthly charts to understand its future trend.

The all-time of Reflex Industries Limited is 335 Rs. Now the stock is trading at nearly its all-time high. If the stock continues its trend and sustains above the 335 Rs level then its first target will be 380 second target will be 425 and third target will be 552.

The stock is following a higher high and higher low pattern on the monthly chart.

Read More: Ircon International Limited Share Price Target

Major supports and resistance for Refex Industries Ltd.

The first major support for the stock is 266, the second support is 240, and the third support is 208.

The first major resistance for the stock is 342 the second resistance is 438 and the third resistance is 552.

Refex Industries Ltd. Share Price Target

| Year | Minimum | Maximum |

| 2023 | 306 | 388 |

| 2024 | 374 | 438 |

| 2025 | 422 | 544 |

| 2026 | 536 | 704 |

| 2027 | 682 | 879 |

| 2028 | 864 | 1030 |

| 2029 | 1002 | 1213 |

| 2030 | 1196 | 1415 |

Refex Share Price Target 2023

The share price target for 2023 will be a minimum of 306 and a maximum of 388.

Refex Share Price Target 2024

The share price target for 2024 will be a minimum of 374 and a maximum of 438.

Refex Share Price Target 2025

Refex industry’s share price target for 2025 will be a minimum of 422 and a maximum of 544.

Refex Share Price Target 2026

Refex industry’s share price target for 2026 will be a minimum of 536 and a maximum of 704.

Refex Share Price Target 2027

Refex Industries’ share price target for 2027 will be a minimum of 682 and a maximum of 879.

Refex Share Price Target 2028

Refex Industries’ share price target for 2028 will be a minimum of 864 and a maximum of 1030.

Refex Share Price Target 2029

Refex Industries’ share price target for 2029 will be a minimum of 1002 and a maximum of 1213.

Refex Share Price Target 2030

Refex Industries’ share price target for 2030 will be a minimum of 1196 and a maximum of 1415.

Conclusion:

Refex Industries Ltd is fundamentally and technically strong. The promoters holding in the company will show that the promoters believe that the company will grow in the future and the ratios of the balance sheet are quite decent. The trend of the stock is showing strength in the upside moment possible. So before investment check all the ratios and balance sheets once again and check the market condition and sector performance before investment if you like this article comment below and share this article with your friends and family and rate us.

Read More: RVNL Share Price In Target and Future Prediction

Dear sir best advisory by moanishgoyel

Sir please rectify price as it split to Rs2. Face valur

There is no change company is fundamentally strong. The split is made for liquidity so don’t panic stay invested