Kirloskar Electric Company Ltd. Share Price Target 2023, 2024, 2025 Till 2030 in future and its prediction. Is Kirloskar Electric Ltd.’s share a good stock to buy for long-term investment? Are you searching for this? Then you are in the right place. In this article, I am going to analyze Kirolskar’s electronic share price based on a fundamental technical analysis.

Overview of the company

The company was Incorporated in 1946 and the founder of the company was Mr. Ravi L. Kirloskar. A company engaged in manufacturing of electrical and power equipment.

The main products of Kirloskar Electric Company Ltd. are AC Motors, AC generators, electronics, Traction equipment, Transformers, and Switchgear, and it Undertakes turnkey Electrical projects.

Fundamentals of Kirloskar Electric Company Ltd.

| Sector | Electric Equipment |

| Market Cap | 660.62 Cr. |

| PE | 6.02 |

| PB | 5.77 |

| EPS | 16.52 |

| ROCE | 0% |

| Dividend Yield | 0% |

| Cash | 47.26 |

| DEBT | 133.41 Cr. |

| Sales Growth | 20.57% |

| Profit Growth | 153.92% |

Fundamental analysis of Kirloskar Electric Company Ltd.

Fundamental analysis of the company helps us to know the financial conditions of the company. So some ratios are analyzed to understand the financial conditions of the company.

Sales Growth: The sales growth of the company for the last year is 20.57% and for the last 3 years is 4.36% which indicates that the sales are increasing yearly.

Profit growth: The profit growth of the company for the last year is 153.92% and for the last 3 years is 72.38% which indicates that the profits are increasing yearly.

Debt/Equity: The debt-to-equity ratio is used to measure how a company is financing its operations through debt versus its own funds. And debt to equity ratio of the company is -0.52. Which is less than 1 and it is good for the company.

Interest Cover Ratio: IC Ratio is used to measure how easily a company can pay interest on its outstanding debt. The company’s interest cover ratio is 3.02.

PE Ratio: The PE ratio of the company is low which is 6.03 and the company is now undervalued.

Dividend Yield: The current year dividend of the company is Rs 0 and the yield is 0%.

Shareholding pattern of Kirloskar Electric Ltd.

It is better to understand the shareholding pattern in the company which tells whether the promoters pledging their stake to manage the finances of the company.

Promoter holding in the company is 49.51% which is less than 50% which indicates the promoter’s holding on the company is decreased.

FII and DII holdings in the company are 1.44% and 4.5% which is below 10% and the company is not able to attract investors.

Holding in the company is 44.55% which is more than 10% which will create more liquidity in the stock market.

The promoters pledging in the company is 75.68% which is not a good sign for the company.

Read More: NHPC Ltd. Share Price Target

Technical analysis of Kirloskar Electric Ltd.

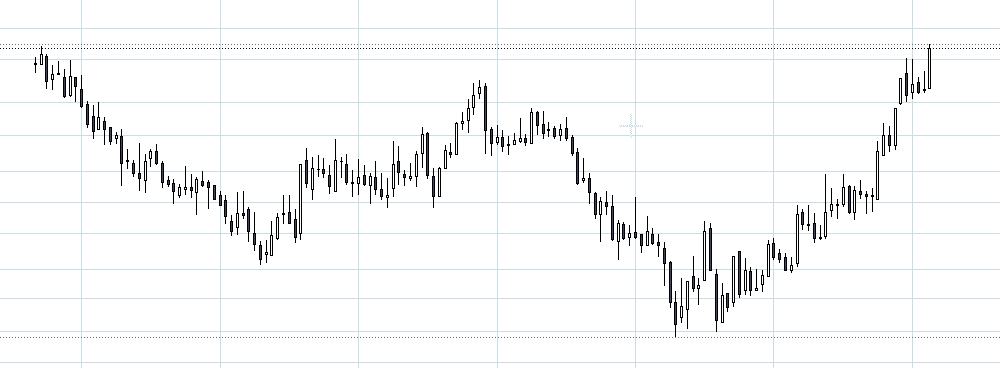

Kirloskar Electric Ltd. Monthly Chart

To better understand the next movement of the stock we are taking a monthly chart to analyze the stock. Now monthly chart the stock is trading near its all-time which is Rs. 103. Now the stock is trading at 99.65 Rs.

The stock is following the zigzag pattern making higher highs and higher lows. If the stock breaks its all-time high level and sustains above this level then its first target will be 165, the second target will be 261, and the third target will be 360.

The major supports for the stocks are: first support is 81, second support is 66, and third support is 55.

Kirloskar Electric Share Price Target/Forecast/Prediction

| Year | Minimum | Maximum |

| 2023 | 90 | 124 |

| 2024 | 118 | 165 |

| 2025 | 152 | 223 |

| 2026 | 211 | 305 |

| 2027 | 288 | 416 |

| 2028 | 398 | 516 |

| 2029 | 507 | 621 |

| 2030 | 605 | 732 |

Kirloskar Electric Share Price Target 2023

The company’s financial conditions are not so good but the company’s sales growth and profit growths are good so the experts believe that the share target will be a minimum of 90 and the maximum will be 124.

Kirloskar Electric Share Price Target 2024

The company is engaged in the manufacturing and sales of AC motors, DC motors, Transformers, Ac generators, and traction. And products of the company are used in power generation, Transmission and Transportation, Sugar industries, Steel industries, and cement industries.

The growing industries can boost sales of the company so the share price target for 2024 will be a minimum of 118 and a maximum will be 165.

Kirloskar Electric Share Price Target 2025

The company has a strong client network including large companies like ACC, BPCL, BHUSHAN, HPCL, ESSAR, IOCL, ADITYA BIRLA, CEAT, HMT, TATA, and JSW. These companies can help to increase sales of Kirloskar Electric Ltd. So the share price target of the company for 2025 will be a minimum of 152 and a maximum of 223.

Kirloskar Electric Share Price Target 2026

Kirloskar Electric’s Share Price Target for 2026 will be a minimum of 211 and a maximum of 223.

Kirloskar Electric Share Price Target 2027

Kirloskar Electric Share Price Target 2027 will be a minimum of 288 and a maximum of 416.

Kirloskar Electric Share Price Target 2028

Kirloskar Electric’s Share Price Target for 2028 will be a minimum of 398 and a maximum of 516.

Kirloskar Electric Share Price Target 2029

Kirloskar Electric’s Share Price Target for 2029 will be a minimum of 507 and a maximum of 621.

Kirloskar Electric Share Price Target 2030

Kirloskar Electric’s Share Price Target for 2030 will be a minimum of 605 and a maximum of 732.

Conclusion:

Kirloskar Electric Company Ltd. Is an Electric Equipment sector company and its financial conditions are not so good right now but the stock is technically strong now and it is near to its all-time. If the stock follows its trend in the future then it can give good returns to its investors. All financial and technicals explained above can be considered before investing. Check market conditions and sector performance once again. If you like this article then share it with your friends and family and comment below and rate us.

Read More: Best Stocks To Buy Today Under 100 Rs In 2023