Welcome to another article on Infosys share price target 2023, 2024, 2025, 2030, 2035, 2040, 2045 2050. In this article, we are going to analyze the Infosys share price target for the future Infosys share price prediction based on its technical s and fundamentals. After studying the details of the stock we will conclude as to whether it is worth long-term investment or not. So before moving in-depth understand its history.

History of Infosys

Infosys is an Indian-based IT company which is incorporated in 1981 by 7 engineers in Pune.

In 1980 Infosys established the Revolutionary Global Delivery model which delivers cost-effective IT services by leveraging India’s talent poll, which became a blueprint for the Indian IT industry to enter in global market.

In 1992 Infosys was listed on the Bombay Stock Exchange.

In 1994 the company established the Infosys Foundation for social service.

In 1999 listed on NASDAQ and became the first Indian company which be listed on the US Stock Market.

Products and Services of Infosys

Infosys offers a portfolio of Pre-built software solutions and platforms such as fashion integrated AI platform, Infosys Topaz, and Infosys Cobalt.

Key services of Infosys

Infosys provides consultant services, application development and maintenance services, business process management, cyber security, and digital marketing services.

The customer base of the Infosys

Infosys creators to board a range of industries including

Automotive

Agriculture

Aerospace and defense

Financial Services

Chemical manufacturing

Retail

Healthcare

Utilities

Life Sciences

Management of Infosys

Ravi Venkatesan a chairman of Infosys has experience in global companies like Microsoft and Unilever.

Jeffery Ubben is an independent director who has expertise in investment banking and private equity.

Peer competitors of Infosys in India

Tata Consultancy Service Limited

Wipro

Cognizant

Global competitors of Infosys

Accenture

IBM

Capgemini

Financial highlights of Infosys

| Sector | IT-Software |

| Market Cap | 687211.22 Cr. |

| PE | 27.87 |

| PB | 8.63 |

| Dividend Yield | 2.07% |

| Book Value | 191.89 |

| Cash | 6534 Cr. |

| DEBT | 0 |

| EPS | 59.41 |

| Sales Growth | 19.31% |

| Profit Growth | 9.57% |

| ROCE | 46.41% |

| ROE | 34.33% |

Some major ratios analysis of Infosys

Profitability ratios

> gross profit margin is 42.5% which indicates Infosys returns a significant portion of revenue at gross profit.

> Operating profit margin 20.5% which measures the efficiency of converting sales into operational profit.

> Net profit margin 10.9% the percentage of revenue remaining as net profit after all expenses

> Return on equity is 25.3% this indicates high profitability related to shareholders’ investment.

Liquidity ratios

> The current ratio is 2.1 which is good for shortening solvency.

>The quick ratio is 1.8% which is slightly lower than the current ratio.

Efficiency ratios

>The inventory turnover ratio is 7.8x which signifies efficient inventory management.

>Account receivable turnover is 8.2x which indicates that the company made efficient Credit Management.

>The asset turnover ratio is 0.8x which indicates how effectively assets are used to generate revenue, relatively low compared to its Peers.

Debit ratios

> Debt to equity ratio of Infosys is 0.2 which indicates a strong financial position.

>The interest coverage ratio is 48x which shows strong financial health.

Market ratios

The price-to-earnings ratio is 28x which is higher than the IT industry average, which indicates Infosys is overvalued.

The price-to-book ratio is 3.5x which is higher than the IT industry average which indicates Infosys future earnings have high potential.

Technical analysis of Infosys

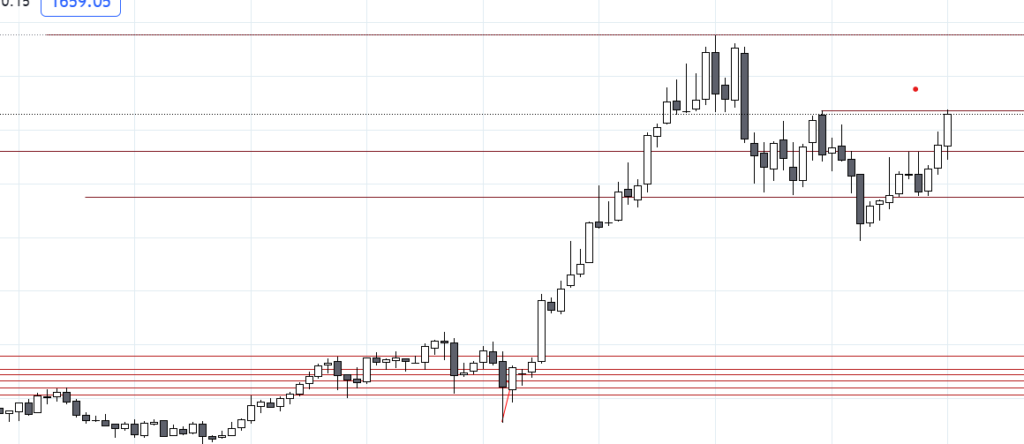

Infosys’s Technical analysis of the monthly chart gives us the trend direction of the stock so we are taking the monthly chart for analysis of the stock.

On the monthly chart after making a lower low now the stock is making a higher high which indicates that the stock is in an upward trend. So the major support of Infosys is now 1520, the second support is 1350 and major resistance for Infosys is now 1820 and the second resistance is 1955.

Infosys Share Price Targets

| Year | Minimum | Maximum |

| 2024 | 1542 | 1822 |

| 2025 | 1784 | 1955 |

| 2030 | 1802 | 2991 |

| 2035 | 3856 | 4686 |

| 2040 | 5213 | 6401 |

| 2050 | 7345 | 8943 |

Infosys Share Price Target 2024

Due to the strong financial condition of Infosys, we are expecting Infosys’ share price for 2024 will be a minimum of 1542 and a maximum of 1822.

Infosys Share Price Target 2025

Strong management and global presence of the company indicate that the share price of Infosys for 2025 will be a minimum of 1784 and a maximum of 1955.

Infosys Share Price Target 2030

The demand for AI will boost the company’s performance in the future so the Infosys share price target for 2030 will be a minimum of 1802 and a maximum will be 2991.

Infosys Share Price Target 2035

Infosys Share Price Target for 2035 will be a minimum of 3856 and a maximum of 4686.

Infosys Share Price Target 2040

Infosys Share Price Target for 2040 will be a minimum of 5213 and a maximum will be 6401.

Infosys Share Price Target 2050

Infosys Share Price Target for 2050 will be a minimum of 7345 and a maximum of 8943.

Strength of Infosys

1 Strong brand reputation and global presence in it service industry.

2 high profitability and stable financial position of the company.

3 diversified client base and industry exposure.

4 the company focuses on digital transformation and automation like AL, cloud, and automation Technology.

5 skilled workforce and strong Talent pool.

Weakness of Infosys

1 ratio suggests the company has a high valuation compared to its peers.

2 dependency on large clients.

3 Limited exposure to hydro markets.

4 competition from established and emerging players.

5 Exposure to Geo political uncertainty.

Opportunities for Infosys

Expanding into emerging markets

Adopting cutting-edge Technologies.

Strengthening focus on digital transformation services

Acquisitions and strategic partnerships

Focus on sustainability and social responsibility

Threads for the Infosys

Automation and offshoring

Economics slow down

Cyber security threats

Changes in government regulations

Talent retention and competition

Recent news about Infosys.

Recently Infosys acquired Insemi a leading Sunny conductor design service provider for rupees 280 crore. this will strengthen Infosys’ capability in cheap designs and position them to capitalize on the growing demand for advanced semiconductor Technologies.

Last 5-year dividend history of Infosys

Infosys declares typically a one-time interim dividend and a one-time final dividend every year.

The dividend yield of Infosys has fluctuated over the past 5 years but it has remained relatively consistent above 2%.

| Financial Year | Interim Dividend (INR per share) | Final Dividend (INR per share) | Total Dividend (INR per share) | Dividend Yield (%) |

| 2023-24 | 17.50 | Not yet declared | 17.50 | 2.16% (annualized) |

| 2022-23 | 15.00 | 18.00 | 33.00 | 4.06% |

| 2021-22 | 14.00 | 12.00 | 26.00 | 3.20% |

| 2020-21 | 9.50 | 12.00 | 21.50 | 2.64% |

| 2019-20 | 8.00 | 10.50 | 18.50 | 2.28% |

Shareholding pattern of Infosys

Promoter holding in the company is 14.78% which is small as compared to institutional investors this indicates a dispersed ownership structure.

DIIs holding in the company is nearly 35.70%.b which signifies strong domestic investor confidence in Infosys.

FIIs holding in Infosys is 33.69% which indicates the smart money believes that the company has future growth.

Public holding in the company is 15.83%.

Conclusion:

Infosys has strong management, financial health, and global presence will indicate that this is the best stock for long-term investment if you consider long-term investment. The company has a strong track record of good returns for its investors. So before investing in a company consider all market conditions.