Wel comes to our blog. Here we discuss various aspects of the Aarti Drugs share price prediction and forecast target for 2024 2025, and 2050. Based on fundamentals, technical analysis, and developments in the company. We focus on providing our readers with the latest and best information on the latest developments in the company. Based on the information we predict the share price of the company. Hope you will get full information about the company.

Company Information

| Sector | Pharmaceuticals & Drugs |

| Company Name | Aari Drugs Limited |

| Symbol | AARTIDRUGS |

| Incorporated | 1984 |

| Listed | BSE 1993, NSE 2003 |

| Headquarter | Mumbai, Maharashtra. |

| Chairman | Mr. Prakash M. Patil. |

| Web site | https://www.aartidrugs.co.in/ |

In 1996 the company made an amalgamation of Rupal Chemical Industries Ltd, Rashesh Chemicals and Pharmaceuticals Ltd, and Manjarati Plastisizer Pvt. Ltd, Effective Chemicals Pvt. Ltd, Star Aluminium Industries Ltd, and Avez Wire Industries Ltd.

In 1998 it company crossed its 100 Cr. Turnover. In 2014 the company crossed 1000 Cr turnover and entered formulation through 100% subsidiary Life Science Pvt. Ltd. In 2022 the consolidation revenue is Rs. 2500 Cr.

Business areas

Aarti Drugs Ltd is one of the leaders in API( active pharmaceutical Ingredients) manufacturing in India. The company is the largest producer of Metronidazole in India. The largest producer and supplier of Nimesulide, Ketoconazole, Metronidazole, Tinidazole, Fluoroquinolones, and Metformin in the world.

Aarti Drugs Ltd is a leading API producer of more than 50 molecules for anti-biotics, antiprotozoal, anti-inflammatory, anti-diabetic and anti-fungal, etc. The API production contributes an average of 80% of its Revenue.

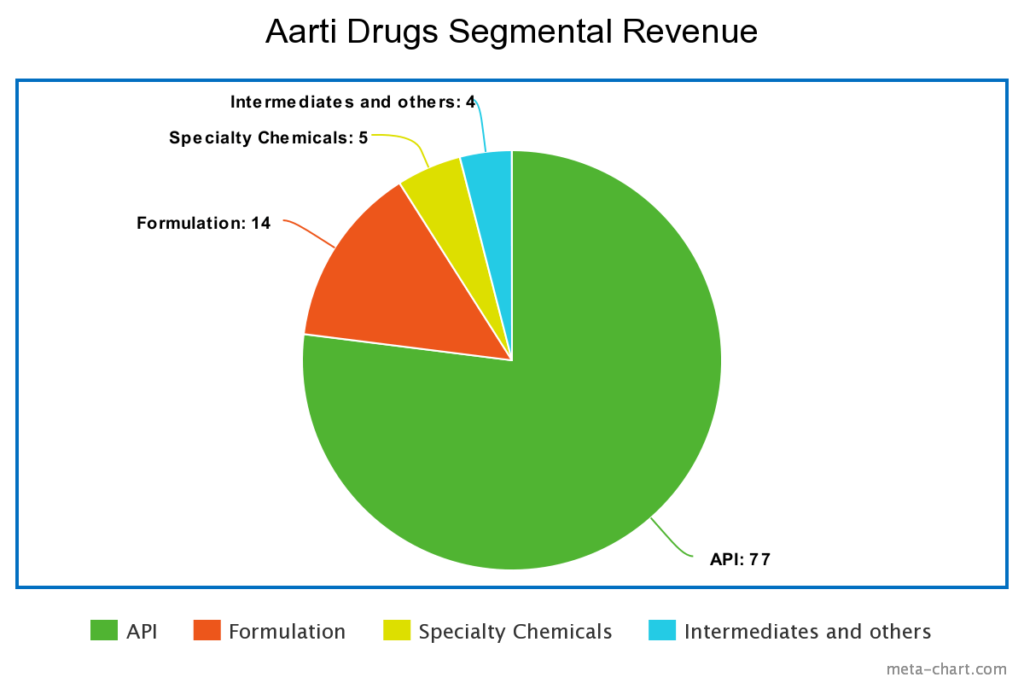

Segmental Revenue

Therapeutic-wise Revenue

Anti-biotic: 46%

Anti-protozoal: 19%

Anti-inflammatory: 10%

Anti-diabetic: 13%

Anti-fungal: 9%

Others: 4%

The exports its products to more than 100 countries and the top countries are Brazil, Pakistan, Indonesia, Egypt, Switzerland, Mexico, Turkey, UAE, Germany, etc.

Major clientele across segments

The company supplies its API to some major companies like Intas, Cipla, Mankind, Zydus Cadila, Alembic Pharma, Sun Pharma, Pfizer Zoetis, etc.

Fundamentals of Aarti Drugs Ltd

| Market cap | 3721.59Cr. |

| No of shares | 9.26 Cr. |

| EPS | 16.48 |

| PE | 24.38 |

| PB | 3.60 |

| Dividend Yield | 0.24% |

| Book value | 111.78 |

| ROE | 14.75 |

| DEBT | 514.88 Cr. |

| Sales Growth | 17.56% |

Sales of the company increasing yearly indicate the company is expanding its market and generating profit.

Low-interest coverage ratio signifies a higher debt burden for the company but in Aari Drugs’ case, the company has a healthy Interest Coverage ratio of 12.08.

Healthcare companies usually have debt on their balance sheet but in Aarti Drugs’ case, the Debt Equity ratio is 0.53 which is a strong indication of the company’s good performance.

EPS growth is a major indication of company growth. Growing EPS is better for investors. But Aarti Drugs, ‘ EPS growth was -23.84% which is a bad indication for the company.

ROE is a major financial parameter to major how efficiently a shareholder’s fund is used for generating profits. ROE of the Aarti Drugs is 21.29% which is good for the company.

No stake pledging in Aarti Drugs. But the company has 514.88 Cr debts on its balance sheet; which is a negative sign for the company.

Aart drugs Share Price History

Aarti Drugs listed in NSE on 1 Jan 1999 opened at 1.70 with positive direction making a high 2.55 for the day. On 1 Feb 2000, the stock made an all-time high of 6.20 and terns downtrend and made low of 1.65 on 2 April 2001.

On 1 Sep 2003, the stock opened a gap of almost 7.6 Rs with a strong breakout made high of 23.10 on 1 July 2005. And started a downtrend making a low of 3.95 Rs. On 02 Feb 2009. Again the stock bounced back and made a high of 218.75 on 1 April 2015. This is an all-time high for the stock. Again the stock goes inside ways range up to 4 May 2020 and breaks its range making again an all-time high of 1026.95. This is its all-time as of now. Due to covid reason, the stock lost its movement now the stock is trading near 400.

Aarti Drugs Share Holding Pattern

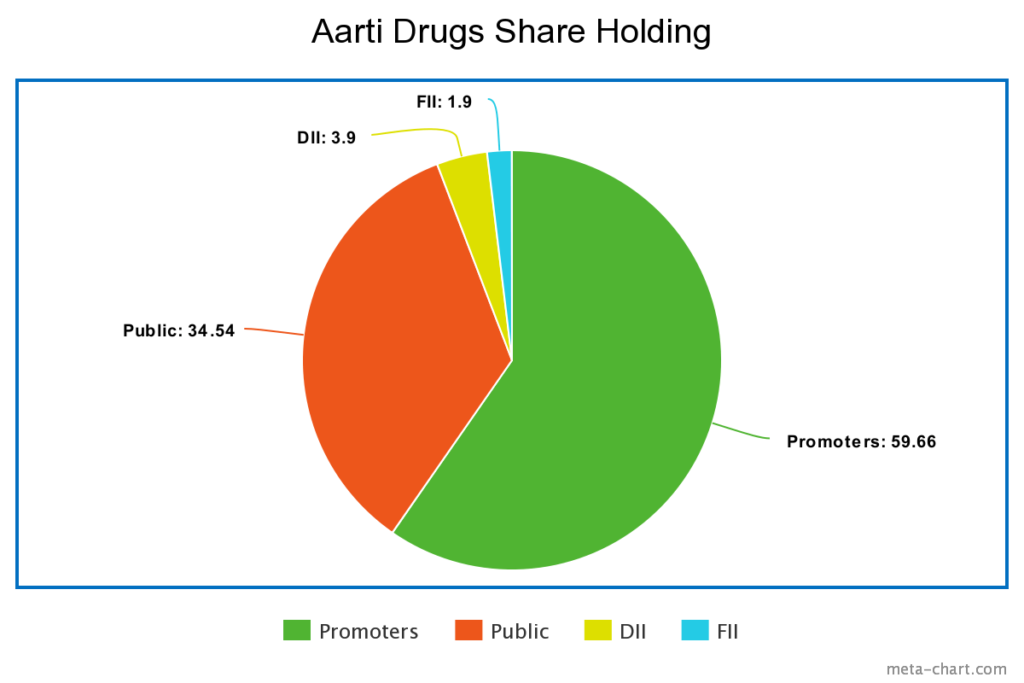

Promoter holding in the company is good which indicates that the promoter believes that they will grow.

FII and DII holding is very low which indicates the smart money will have less interest in the company.

Public holding is more than 10% which creates more liquidity in the market. More supply of the stock less demand for the stock.

Technical Analysis of Aarti Drugs Share

Today Aarti Drugs share is trading at nearly 400 in NSE, with the major support of share 479 and the major resistance for the share is 512 in the monthly chart. The share is trying to take support right now after a big move. If the stock sustains above 476 the stock counties its uptrend rally.

The stock is a fundamentally strong and technical week right now but the companies’ sales growth and profit growth indicate that the company will move uptrend.

The Future of Aarti Drugs Share

Aarti Drugs is of Export-oriented Pharma company. The main Revenue comes from API,s sales. After the Covid period, the export of the is increasing now which will boost the company’s performance in the future. The promoters have faith in its growth. The company also pays a dividend to its shareholders which gains the trust of the investors.

Aart Drugs Share price Prediction/ Forecast/Target

| Year | Minimum | Maximum |

| 2023 | 379 | 430 |

| 2024 | 425 | 512 |

| 2025 | 502 | 628 |

| 2030 | 842 | 1041 |

| 2035 | 1410 | 1682 |

| 2040 | 1857 | 2084 |

| 2045 | 2561 | 2716 |

| 2050 | 3264 | 3852 |

Aarti Drugs Share Price Target 2023

The share price Of Aarti Drugs in 2023 will be a minimum of 379 and a maximum of 430. The expected target will be 422.

Aarti Drugs Share Price Target 2024

Aarti Drug’s share price target in 2024 will be a minimum of 425 and a maximum of 512. The expected target will be 505.

Aarti Drugs Share Price Target 2025

Aarti Drugs’ share price target in 2025 will be a minimum of 502 and a maximum of 628. The expected target will be 623.

Aarti Drugs Share Price Target 2030

Aarti Drugs’ share price target in 2030 will be a minimum of 842 and a maximum will be 1041. The expected target will be 1036.

Aarti Drugs Share Price Target 2035

Aarti Drug’s share price target in 2035 will be a minimum of 1410 and a maximum will be 1682. The expected target will be 1676.

Aarti Drugs Share Price Target 2040

Aarti Drugs’ share price target in 2040 will be a minimum of 1857 and the maximum will be 2084. The expected target will be 2070.

Aarti Drugs Share Price Target 2045

Aarti Drugs’ share price target in 2045 will be a minimum of 2561 and a maximum will be 2716. The expected target will be 2702.

Aarti Drugs Share Price Target 2050

Aarti Drugs’ share price target in 2050 will be a minimum of 3264 and a maximum will be 3852. The expected target will be 3843.

Conclusion:

The Parma companies have great opportunities these days and the Govt of India promotes health-oriented programs throughout the nation. The Company has strong management and a good performance record for decades. The sales of the Company growing and revenue also growing. So by concluding all its fundaments and technical’s based the company is good for investment consideration for long term investment. So before investment kindly check all scenarios and take advice from financial advisers opinion. For more details comment below or mail us and stay connected with us.