Hi, are you searching for a Bank of Baroda share price target, prediction, and forecast then you are in the right place. In this article, we analyze the Bank of Baroda based on fundamental and technical analysis. The detailed analysis is given below so let’s move.

Bank of Baroda was founded by Maharaja Sayajirao Gaekwad in July 1908 at Vadodara in Gujarat. Bank of Baroda’s headquarters is in Vadodara and it has a corporate office in Mumbai.

On April 1, 2019, Vijay Bank and Dena Bank amalgamated into Bank of Baroda which provides long-term benefits to the Bank and its customers.

The bank upgraded its technology to improve customer experience. The bank applied some initiatives such as a digital account opening system through TAB Banking, the latest mobile application, centralization of back office operations, etc.

The bank is setting up of digital Lending Department which will exclusively cater to digital onboarding and processing of loans for MSME customers and its retail customers using internal and external sources of information and machine algorithms.

The bank is engaged in providing various services such as personal banking, corporate banking, international banking, rural banking, small and medium enterprise banking, treasury services, and non-residential Indian services.

Fundamentals of Bank of Baroda

| Sector | Bank-Public |

| Market Cap | 86,827.17 Cr |

| No. of share | 517.14 Cr |

| EPS | 21.49 |

| PE | 7.82 |

| PB | 0.95 |

| ROE | 12.10 |

| Book Value | 12.10 |

| Book Value | 186.18 |

| Net Interest Income | 32.621.34 Cr. |

| Profit Growth | 777.28% |

Fundamental Analysis of Bank of Baroda

The banking companies’ main income comes from interest earned on various loans given to the public and corporations. By considering this Bank of Baroda has earned Rs 69,880.78 Cr. Last year. The bank shows decent revenue growth of 11.98% in the last 3 years.

Bank of Baroda is now trading at 0.90 P/B as the historical average P/B was 0.66.

The NEP of the Bank of Baroda is 6.61% which indicates the inefficient management of the lending.

The bank pays dividends to its investors every year as a part of the profit and last year the payment of the dividend was 2.85 Rs which is 142.5 % of the share value.

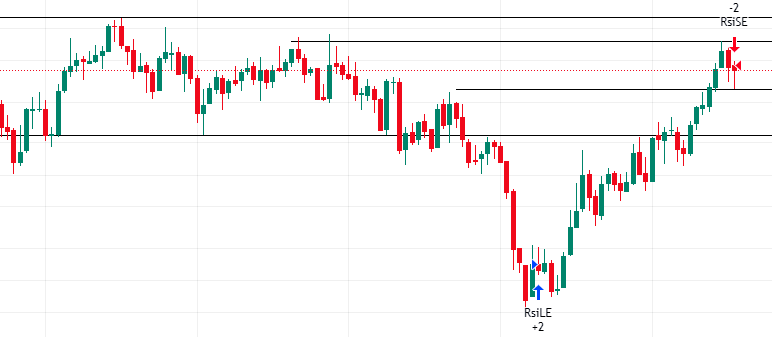

Technical analysis of Bank of Baroda

From a long-term investment point of view, we are taking monthly charts to analyze the chart. Bank of Baroda is trading near 165 as of Feb 13, 2023, and making Doji on the monthly chart. It suggests that the stock is taking support at the 109 level and is ready to move upward direction once it breaks the 175 level and sustains then the first target will be 197, the second target will be 229 and the third target will be 347.

The major Supports and Resistance for Bank of Baroda are, First support is 109, second support is 90, and third support is 77. Major resistances for the Bank of Baroda are, first resistance is 181, second resistance is 197, and third resistance is 229.

Share Holding Pattern of Bank of Baroda

Promoter holding in Bank of Baroda is more than 50% which indicates a strong belief in the bank’s growth in the future.

DII holding in banks is more than 10% which is 17.95% which indicates smart money has faith in the bank.

FII holding in the bank is below 10% but it is negligible which indicates the smart money interest in the bank.

Public holding in the bank is below 10% which is good for bank share price stability in the market. Public panic when some bad news comes against banks and panic sells all their stack creates liquidity. Below 10% minimizes the liquidity.

Bank of Baroda Share Price Target

| Year | Minimum | Maximum |

| 2023 | 146 | 197 |

| 2024 | 190 | 269 |

| 2025 | 260 | 347 |

| 2030 | 440 | 546 |

| 2035 | 624 | 740 |

| 2040 | 821 | 1050 |

| 2045 | 1271 | 1566 |

| 2050 | 1788 | 2073 |

Bank of Baroda Share price prediction and target

Bank of Baroda share price target 2023

Bank of Baroda’s share price target for 2023 will be a minimum of 146 and a maximum will be 197. The expected target will be 192.

Bank of Baroda share price target 2024

Bank of Baroda’s share price target for 2024 will be a minimum of 190 and a maximum will be 269. The expected target will be 263.

Bank of Baroda share price target 2025

Bank of Baroda’s share price target for 2025 will be a minimum of 260 and a maximum will be 347. The expected target will be 340.

Bank of Baroda share price target 2030

Bank of Baroda’s share price target for 2030 will be a minimum of 440 and a maximum will be 546. The expected target will be 537.

Bank of Baroda share price target 2035

Bank of Baroda’s share price target for 2035 will be a minimum of 624 and a maximum will be 740. The expected target will be 732.

Bank of Baroda share price target 2040

Bank of Baroda’s share price target for 2040 will be a minimum of 821 and a maximum will be 1050.

The expected target will be 1038.

Bank of Baroda share price target 2045

Bank of Baroda’s share price target for 2045 will be a minimum of 1271 and a maximum will be 1566. The expected target will be 1552.

Bank of Baroda share price target 2050

Bank of Baroda’s share price target for 2050 will be a minimum of 1788 and the maximum will be 2073. The expected target will be 2064.

Conclusion:

Selecting the right stock for long-term investment big task for retail investors. The fundamentals and technicals of the Bank of Baroda are good to consider for investment. The interest earnings of the bank are decent as compared to other banks. So before the investment has looked at market conditions and sentiments. Right entry into the stock is key to success in the stock market. All details discussed above are based on our analysis. So before investing check all scenarios. For more information and details you can email us or comment below and if you like this article share your friends and family.