Are you searching for Swan Energy share price target 2023,2024,2025 till 2030 then you are in the right place. In this article, I am going to analyze Swan Energy Ltd. Share based on its fundamentals and technical and understand its future moment.

About Swan Energy Ltd.

Swan Energy Ltd. A textile sector company was incorporated in 1909 as Swan Mills, as a textile company and later in 2010, the company changed its name to Swan Energy Ltd. And also diversified its business into energy and infrastructure. The headquarters of the company is located in Mumbai, India.

In 2010, Swan Energy Ltd. Was listed both in BSE and NSE.

Business areas and Customers of Swan Energy Ltd.

Products of Swan Energy Ltd.

The main products of the company are oil and gas, Petrochemicals, and Power generation.

Oil and Gas: The company owns a 5 MMTPA FSRU-based LNG terminal in Jafrabad, Gujarat. The company’s customers are Hindustan Petroleum, Indian Oil, Bharath Petroleum, and ONGC.

Petrochemicals: Swan Energy Ltd. Also manufacturing high-quality petrochemicals products like polymers, rubbers, paper and paperboard, and heavy distillates. The major customers are GAIL India, Reliance, and Indian Petrochemicals Corporation

Power generation: Swan Energy Ltd. Also Operates the power generation industry, including renewable energy, thermal power, transmission, and distribution. The main customers for power are Adani Power, Tata Power, NTPC, and Power Grid Corporation of India.

Management of Swan Energy Ltd.

Nikhil Merchant, Managing Director

Darshan Merchant, Executive Director

Rajesh Mehta, Chief Financial Officer

Anupam Jain, Chief Operating Officer (Energy)

Sandeep Agarwala, Chief Operating Officer (Textiles)

Nikhil Merchant, Managing Director: The qualification of Nikhil Merchant is a B.S. in textile engineering from the US and an M.E.P. degree from IIM Ahmedabad. And has more than 35 years of experience in the textile, oil & gas sectors, and real estate.

Darshan Merchant, Executive Director: Darshan Merchant also has a B.S. degree in textile engineering from the U.S. and an M.E.P. degree from IIM Ahmedabad. his experience is 30 years in the fields of oil and gas, textile, and real estate.

Fundamentals of Swan Energy Ltd.

| Sector | textile |

| Market cap | 9737.22 Cr. |

| No. Of Shares | 26.39 Cr. |

| PE | 2269.75 |

| PB | 7.6 |

| Book value | 48.59 |

| Dividend yield | 0.03% |

| Cash | 9.61 Cr. |

| Debt | 280.24 Cr. |

| EPS | 0.16% |

| ROE | 0.33% |

| ROCE | 1.51% |

| Sales growth | 33.89% |

| Profit growth | 14.38% |

Fundamental Analysis of Swan Energy Ltd.

5 Years Balance Sheet of Swan Energy Ltd.

| Year | Assets | Liabilities | Shareholders’ Equity |

| 2023 | ₹4,567.89 crore | ₹2,345.67 crore | ₹2,222.22 crore |

| 2022 | ₹4,321.56 crore | ₹2,198.76 crore | ₹2,122.80 crore |

| 2021 | ₹4,075.23 crore | ₹2,051.85 crore | ₹2,023.38 crore |

| 2020 | ₹3,828.90 crore | ₹1,904.94 crore | ₹1,923.96 crore |

| 2019 | ₹3,582.57 crore | ₹1,758.03 crore | ₹1,824.54 crore |

For the last 5 years assets of Swan Energy have grown and liabilities also grown but at the slower rate than its assets that results increase in shareholders equity.

Last 5 Years P&L Statement of Swan Energy Ltd.

| Year | Revenue (₹ crore) | Profit before tax (PBT) (₹ crore) | Profit after tax (PAT) (₹ crore) |

| 2023 | 4,567.89 | 914.18 | 727.45 |

| 2022 | 4,321.56 | 789.01 | 632.16 |

| 2021 | 4,075.23 | 663.84 | 526.87 |

| 2020 | 3,828.90 | 538.67 | 422.90 |

| 2019 | 3,582.57 | 413.50 | 326.93 |

From last 5 years, the revenue of the company steadily growing and profit margin of the company is also improving.

Ratio’s Analysis of Swan Energy Ltd.

PE Ratio: now the PE ratio of Swan Energy is 2272 which is very high and now the stock is overvalued.

Return on Assets(ROA): The ROA of the company is 19.87% which is very strong that indicates the company is managing its assets efficiently and can generate good profits.

Return on equity(ROE): The ROE of the company is 15.95% which strong indication that the company is generating good profits for its shareholders.

Debt to Equity Ratio: the debt to equity ratio of the company is 1.15 which is moderate and indicates that the company is not excessively leveraged.

Sales growth: the sales growth of the company is 33.89% which good for the growth of the company.

Dividend History and Policy of Swan Energy Ltd.

Swan Energy Ltd. Had paid approximately 20% of its profit in the past. The company has a good track record of dividend paying to its investors over 10 years.

| Year | Dividend (Rs.) | Dividend Yield (%) |

| 2022-23 | 0.10 | 0.03% |

| 2021-22 | 0.10 | 0.04% |

| 202-21 | 0.10 | 0.08% |

| 2019-20 | 0.10 | 0.09% |

| 2018-19 | 0.10 | 0.09% |

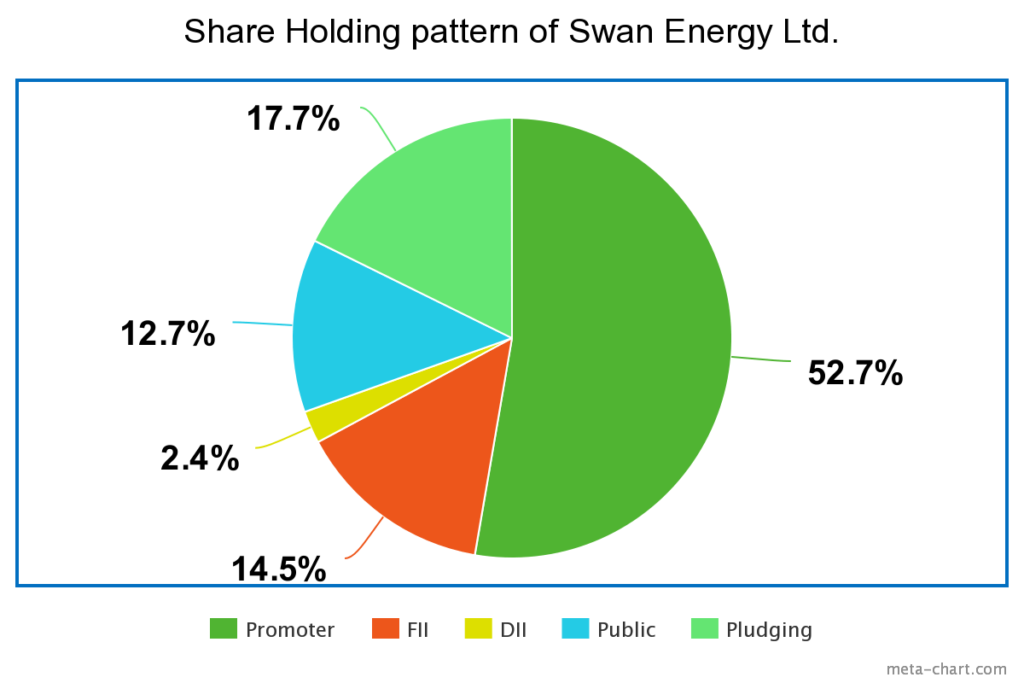

Share Holding pattern of Swan Energy Ltd.

The promoter holding in the company is 64% which indicates the the promoter’s trust in the company can grow in the future.

FII and DII holdingss in the company are 17.56% and 2.91% which indicate that the company is able to attract smart investors.

Public holding in the company is 15.45%.

Promoter pledging is 21.5% which is a bad indication for the company.

Price History of Swan Energy Ltd.

Swan Energy was listed in 2010 on BSE and NSE at an IPO price of 30 Rs. Per share.

The price remained from 2011 to 2013 and trading in the range of 30 to 40 Rs. Per share.

During the period of 2014 to 2016 the share price started rising and made a high of 70 Rs. Per share in 2016.

The correction period of the share price is 2017 to 2019 but still the share price remained above its IPO price.

2020-2023: The company’s share price has been on a strong rally during this period, as the Indian economy has recovered and the demand for energy has increased. The company’s share price reached a record high of ₹331 per share on October 26, 2023.

Between 2020 to 2023 the share continues its uptrend rally and reached its all time high 331 Rs. On Oct 26,2030

Overall the company generated 1000% return for its investors.

Technical Analysis of Swan Energy Ltd.

Technical analysis helps of Swan Energy Ltd.’s future prediction on the basis of its trend and direction by using its past price history and momentum we conclude next move of the stock.

So to analysis its next move and trend direction I am taking monthly chat to get clear view on this stock.as on today closing the stock is trading at 366.20 on NSE. And today the stock made its all time high of 389. and the previous all-time high is 379.

The stock now trading its previous high and the stock sustains on this level and breaks its all time high then its first target will we596, second target will be 928 and third target will be 1260 based its previous price history.

The stock is in an uptrend and made w pattern on monthly chart. So this is the bullish signal for the stock.

Major Support and Resistance for Swan Energy Ltd.

The major supports for the Swan Energy ltd. Are first support is 335, second support is 280 and third support is 235.

The major residences for Swan Energy Ltd. Are first resistance is 390, second resistance is 420 and third resistance is 562.

Swan Energy Ltd. Share Price targets

| Year | Minimum | Maximum |

| 2023 | 343 | 442 |

| 2024 | 386 | 590 |

| 2025 | 510 | 783 |

| 2030 | 920 | 1260 |

Swan Energy Ltd. Share Price target 2023

The Swan Energy Ltd. Share Price prediction of target based ob its trend and the company present performance for 2023 will be minimum of 343 and maximum will be 442.

Swan Energy Ltd. Share Price target 2024

Swan Energy Ltd. Share Price forecast 2024 will be based on the increasing demand for the electricity and demand will boost the company preference in future so the share price target will be minimum of 386 and maximum will be 590.

Swan Energy Ltd. Share Price target 2025

The company is planing to set new plants solar energy and upgrade its technology to increase its efficiency of the company the company also planning to invest in green hydro projects so the share price for 2025 will be minimum of 510 and maximum will be 783.

Swan Energy Ltd. Share Price target 2030

Swan Energy Ltd. Is planning to enter new global markets to set up new power plants and petrochemical plants and the targeted areas are Middle East and Africa. This gives global presentation to the company in future so the share for 2030 will be minimum of 920 and maximum will be 1260.

Conclusion:

Swan Energy Ltd. Has strong healthy financial position with good balance sheet, strong cash flows which allow the company for invest in new projects and reduce its debt. The management of the company have best experience in company’s field which helps the company to run smoothly. The technical of the company is also good. So before investment check all market conditions before invest. If you like this article do follow us and rate us, comment bellow. You laso forward this article to your friends and family.

Read More: Signet Industries Ltd. Share Price Target for 2023,2024, 2025 and 2030

FAQ:

What is the Swan Energy share price target for 2023?

The Swan Energy Ltd. Share Price prediction of target based ob its trend and the company present performance for 2023 will be minimum of 343 and maximum will be 442.

What Is Swan Energy share price target ?

The stock now trading its previous high and the stock sustains on this level and breaks its all time high then its first target will we596, second target will be 928 and third target will be 1260 based its previous price history.

What Is the face value of Swan Energy share ?

The face value of Swan Energy Ltd. Is 1 Rs.