If you are thinking about which stock will be the best for investment in recent times, then you should know about Authum Investment & Infrastructure Ltd. Share Price Target. Today in this blog post I am going to discuss the basics of Authum Investment & Infrastructure Ltd. Share Price Target for 2024, 2025, to 2030. We did deep research and took expert advice to write this blog post and to understand the basics of the company’s growth, performance, Future Plans, etc Of Autumn Investment & Infrastructure Ltd.

Authum Investment & Infrastructure Ltd. is a Finance-Investment sector company listed in both BSE and NSE. In this blog post, we will discuss Authum Investment & Infrastructure Ltd.’s financial growth, business policies, shareholding pattern, and its forecast of share price yearly. we use a lot of website data to analyze and understand Authum Investment & Infrastructure Ltd.’s fundamentals and its future Share Price Target from 2024 up to 2030.

About Authum Investment & Infrastructure Ltd.

Authum Investment & Infrastructure Ltd. is a finance investment company that was incorporated in the year of 1982. The company’s headquarters is located in Mumbai, Maharashtra. The company operates in 25 branches across the country. The company mainly engaged in making long-term equity investments across listed and unlisted companies and recently the company diversified its its business into the development of a fully integrated credit platform.

Business areas of Authum Investment & Infrastructure Ltd.

Authum Investment & Infrastructure Ltd.’s India’s capital market and investment banking sector like

Investment in listed/non-listed securities.

Debt Investment

Structured fixed-return Investments.

Real Estate Investments

Non-Banking Finance

Asset Reconstruction

Asset Management

Advisory services

The company also engaged in investing in developing building complexes, townships, and real estate properties. The company also undertakes construction projects like dams, roads, factories, and residential complexes.

Fundamentals of Authum Investment & Infrastructure Ltd.

| Market Cap | ₹ 28,049.92 Cr. |

| Advances | ₹ 91.49 Cr. |

| P/E | 5.46 |

| Sector P/E | 10.47 |

| P/B | 2.73 |

| Dividend Yield | 0 % |

| Book Value (TTM) | ₹ 669.76 |

| Operating Revenue | ₹ 374.22 Cr. |

| Net Profit | ₹ 240.20 Cr. |

| Promoter Holding | 74.95 % |

| EPS (TTM) | ₹ 216.30 |

| Sales Growth | -58.76 % |

| ROE | 7.86 % |

| ROCE | 8.38 % |

| Profit Growth | -64.08 % |

Fundamental Analysis of Authum Investment & Infrastructure Ltd.

Before investing we need to understand Authum Investment & Infrastructure Ltd.’s major ratios like PE ratio, return on assets, current ratio, and return on equity, etc. In this section, I will discuss the past financial performance of Authum Investment & Infrastructure Ltd. and its future Share Price Target based on the ratios analyzed below.

PE Ratio

The PE ratio is used to measure how much investors are willing to pay for a share of their earnings so Authum Investment & Infrastructure Ltd. has a 5.46% PE ratio compared to its sector PE ratio of 10.47%, indicating that the stock is undervalued compared to its sector.

Profit Growth

The profit growth of Authum Investment & Infrastructure Ltd. last 1 year was -64.08%, for the last 3 years 160.64%, and last 5 years 109.23%, indicating that the company facing challenges in recent times due to external factors like economic conditions and industry disruptions. but overall the company has shown decent profit growth.

Return on Assets

The ROA Authum Investment & Infrastructure Ltd. is used to measure how effectively a company can earn a written on its investment in assets. so Authum Investment & Infrastructure Ltd.’s Return on assets is 5.97% which is a negative sign for the future performance of the company.

Return on Equity

Return on equity (ROE) measures a company’s ability to generate profits from the investments made by its shareholders in the company. It indicates how effectively the company uses shareholders’ capital to produce earnings. So Authum Investment & Infrastructure Ltd. Has a 7.86% ROE which is average. generally higher ROE is better.

Income Growth

Authum Investment & Infrastructure Ltd. has Shown a negative Income growth of -58.76% which is a bad sign for its growth and performance.

PAT Margin

PAT Margin is used to check the operational efficiency of the company to adjust between its costs and revenue to generate healthy profits. Authum Investment & Infrastructure Ltd. has a 64.19% PAT margin which is good. Higher is better for investors.

Dividend Yield

The dividend yield is used to know how much dividend we will receive in relation to the price of stock price. In the current year dividend payout of Authum Investment & Infrastructure Ltd. Is 0 Rs. And the yield is 0%.

Earnings per Share

EPS is used to check how much profit is all located in each outstanding share of a common stock. The current year EPS of Authum Investment & Infrastructure Ltd. Grew by 216%, generally higher EPS is better for its investors.

Read more: Geojit Financial Services Ltd. Share Price Target

Share Holding Pattern of Authum Investment & Infrastructure Ltd.

Promoters: 74.95%

Public: 17.81%

FII (Foreign Institutional Investors): 7.23%

DII (Domestic Institutional Investors): 0.01%

Promoters Holding

Promoter shareholding in the company has increased from 71.47% to 74.95% which indicates that promoters believe that the company can give better performance in the future.

FII Holding

FII holds 7.23% of the company, which indicates interest from international investors in the company’s performance and growth potential in upcoming years.

DII Holding

DII holding in the company is a very small portion of 0.01%, indicating that the domestic institutions have limited confidence in the company.

Public Holding

Public holding in the company is around 17.81% which indicates that Authum Investment & Infrastructure Ltd. has a moderate public trust and participation.

Authum Investment & Infrastructure Ltd. Share Price Target from 2024 to 2030

| Year | Minimum Share Price Target | Maximum Share Price Target |

| 2024 | 1590 | 1828 |

| 2025 | 1822 | 2501 |

| 2030 | 4715 | 5398 |

Authum Investment & Infrastructure Ltd. Share Price Target 2024

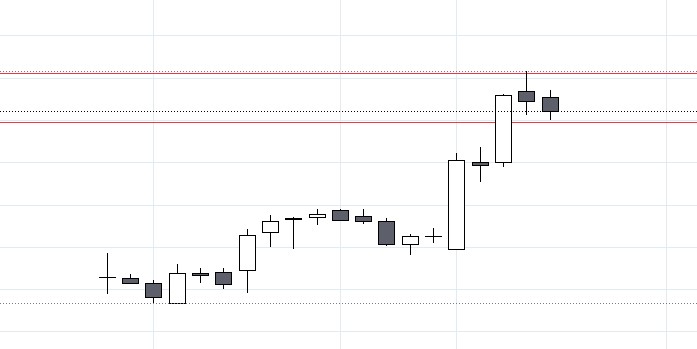

After listing in NSE on 23, April 2024 the stock is making higher highs and higher lows and moving in an uptrend direction. If Edelweiss Financial Services Ltd. sustains a level above 1590 then it will continue its uptrend rally and break its time high of 1830, So as per our analysis, Authum Investment & Infrastructure Ltd.’s Share Price Target 2024 will be a minimum of 1590 and a maximum of 1828.

| Minimum Share Price Target | 1590 |

| Maximum Share Price Target | 1828 |

Authum Investment & Infrastructure Ltd. Share Price Target 2025

Authum Investment & Infrastructure Ltd.’s profit growth has decreased over the last 1 year is -58.76% and over the last 3 years 162.81% and over the last 5 years, 1.58% which shows that the profit growth is unstable but increasing in the stake of promoters indicating that the company will best in future so we are expecting Authum Investment & Infrastructure Ltd. Share Price Target 2025 will be a minimum of 1822 and a maximum of 2501.

| Minimum Share Price Target | 1822 |

| Maximum Share Price Target | 2501 |

Authum Investment & Infrastructure Ltd. Share Price Target 2030

The assets under management are projected to double to US$ 1,207 billion (Rs. 100 trillion) by 2030, indicating a compound annual growth rate (CAGR) of 14% from FY24 to FY30.so This will boost the company’s future performance we are expecting Authum Investment & Infrastructure Ltd. Share Price Target for 2030 will be a minimum of 4715 and a maximum of 5398.

| Minimum Share Price Target | 4715 |

| Maximum Share Price Target | 5398 |

Read More: Edelweiss Financial Services Ltd. Share Price Target

Final Words

Authum Investment & Infrastructure Ltd. has strong financial conditions and strong management. The company has been operating in the market for more than 4 decades with experience in the financial sector. So Investing in fundamental strong stocks and experienced management stocks will give you a good return. After the listing in the stock market, they showed strong purchasing demand. The stock also follows technical and has strong fundamentals. so this post is for reference purposes only not a buy and sale advice. We believe in fundamental strong stocks only. so before investing check the market conditions and sector performance and trends. if you have liked this post comment below share this article with your friends and family and rate us.

What is Authum Investment & Infrastructure Ltd. Share Price Target 2024?

Authum Investment & Infrastructure Ltd.’s Share Price Target in 2024 will be a minimum of 1590 and a maximum of 1828.

What is Authum Investment & Infrastructure Ltd. Share Price Target 2025?

Authum Investment & Infrastructure Ltd. Share Price Target 2025 will be a minimum of 1822 and a maximum of 2501.

What is Authum Investment & Infrastructure Ltd. Share Price Target 2030?

Authum Investment & Infrastructure Ltd.’s Share Price Target for 2030 will be a minimum of 4715 and a maximum of 5398.